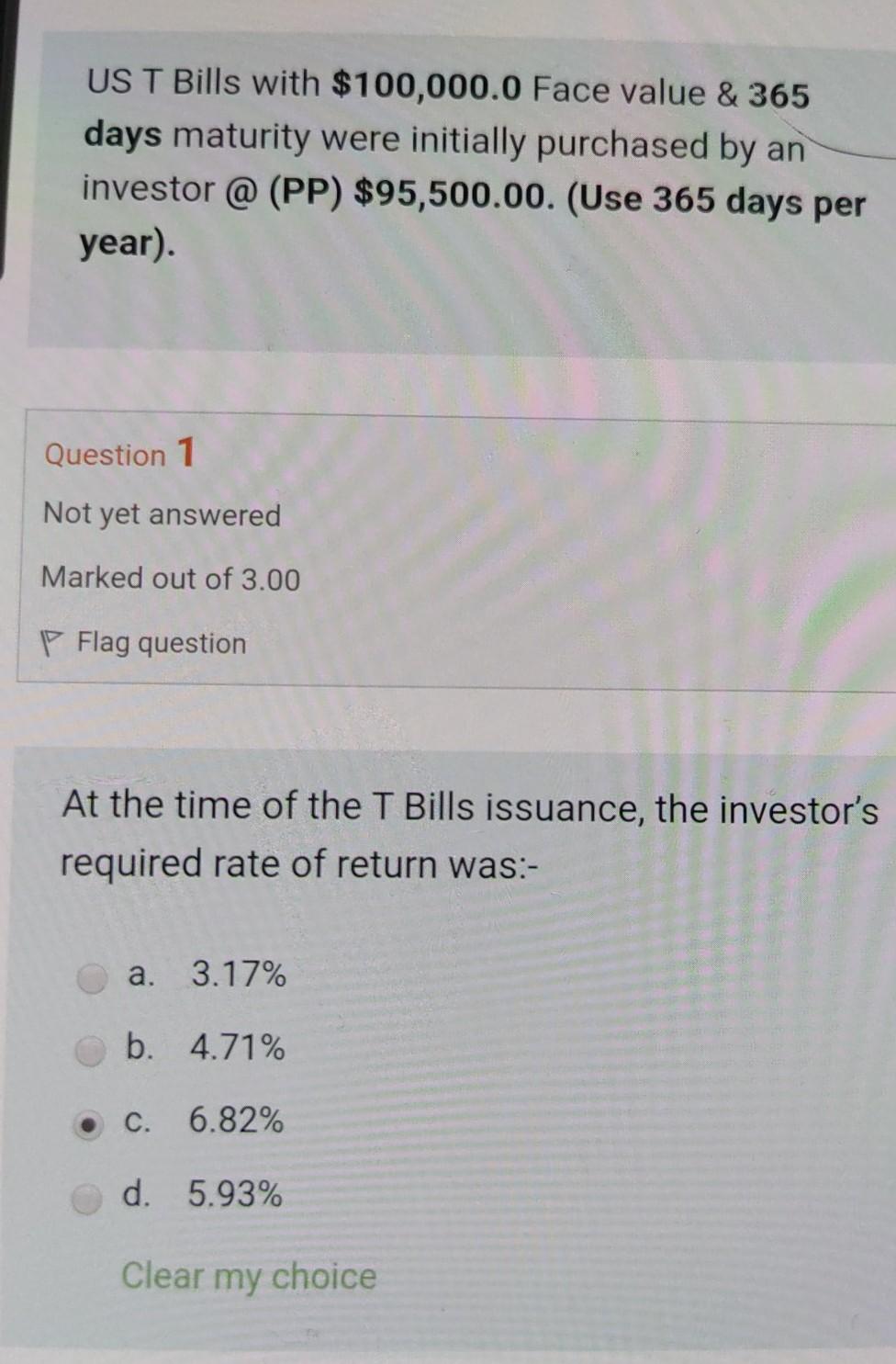

Question: US T Bills with $100,000.0 Face value & 365 days maturity were initially purchased by an investor @ (PP) $95,500.00. (Use 365 days per year)

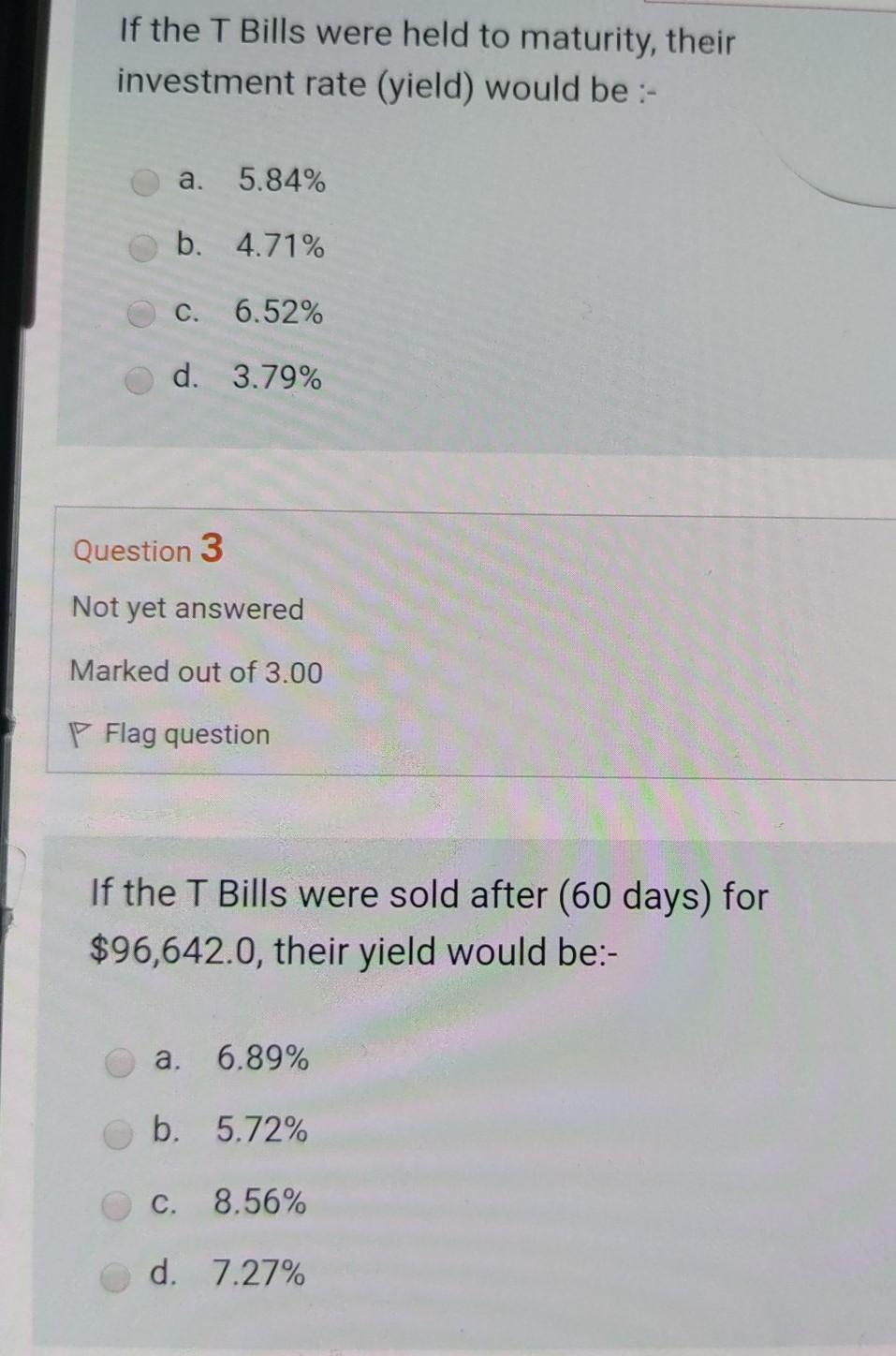

US T Bills with $100,000.0 Face value & 365 days maturity were initially purchased by an investor @ (PP) $95,500.00. (Use 365 days per year) Question 1 Not yet answered Marked out of 3.00 Flag question At the time of the T Bills issuance, the investor's required rate of return was:- a. 3.17% b. 4.71% C. 6.82% d. 5.93% Clear my choice If the T Bills were held to maturity, their investment rate (yield) would be :- a. 5.84% b. 4.71% C. 6.52% d. 3.79% Question 3 Not yet answered Marked out of 3.00 P Flag question If the T Bills were sold after 60 days) for $96,642.0, their yield would be:- a. 6.89% b. 5.72% C. 8.56% d. 7.27%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts