Question: PO 15 Max has been asked to be the executor of his brother's estate (liquidator in Quebec) He has researched the duties and is wondering

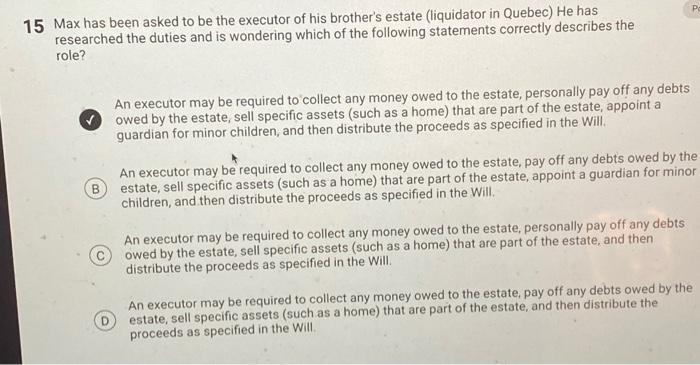

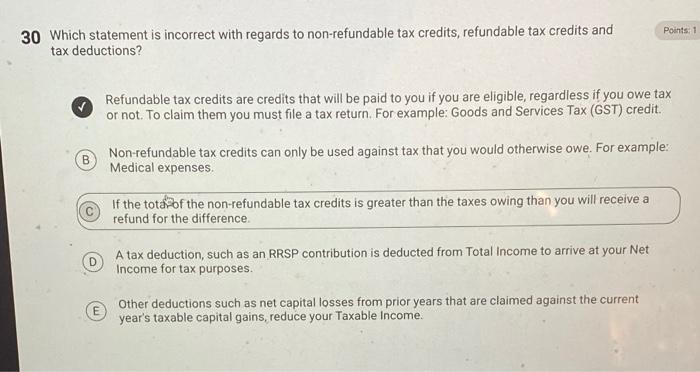

PO 15 Max has been asked to be the executor of his brother's estate (liquidator in Quebec) He has researched the duties and is wondering which of the following statements correctly describes the role? An executor may be required to collect any money owed to the estate, personally pay off any debts owed by the estate, sell specific assets (such as a home) that are part of the estate, appoint a guardian for minor children, and then distribute the proceeds as specified in the Will B An executor may be required to collect any money owed to the estate, pay off any debts owed by the estate, sell specific assets (such as a home) that are part of the estate, appoint a guardian for minor children, and then distribute the proceeds as specified in the Will. An executor may be required to collect any money owed to the estate, personally pay off any debts owed by the estate, sell specific assets (such as a home) that are part of the estate, and then distribute the proceeds as specified in the Will. An executor may be required to collect any money owed to the estate, pay off any debts owed by the estate, sell specific assets (such as a home) that are part of the estate, and then distribute the proceeds as specified in the Will Points: 1 30 Which statement is incorrect with regards to non-refundable tax credits, refundable tax credits and tax deductions? Refundable tax credits are credits that will be paid to you if you are eligible, regardless if you owe tax or not. To claim them you must file a tax return. For example: Goods and Services Tax (GST) credit. B Non-refundable tax credits can only be used against tax that you would otherwise owe. For example: Medical expenses. If the tota of the non-refundable tax credits is greater than the taxes owing than you will receive a refund for the difference. A tax deduction, such as an RRSP contribution is deducted from Total Income to arrive at your Net Income for tax purposes. Other deductions such as net capital losses from prior years that are claimed against the current year's taxable capital gains, reduce your Taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts