Question: point in time. Question 1: (5 * 2marks = 10 marks) Critically evaluate the following statements. A. Market efficiency implies that stock price will be

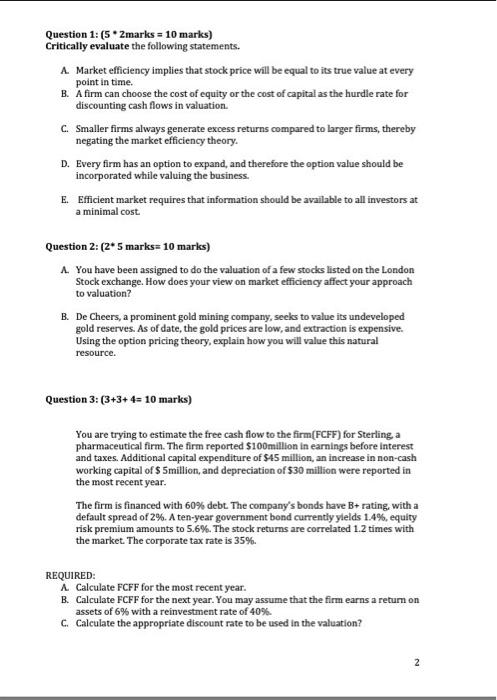

point in time. Question 1: (5 * 2marks = 10 marks) Critically evaluate the following statements. A. Market efficiency implies that stock price will be equal to its true value at every B. A firm can choose the cost of equity or the cost of capital as the hurdle rate for discounting cash flows in valuation. C. Smaller firms always generate excess returns compared to larger firms, thereby negating the market efficiency theory. D. Every firm has an option to expand, and therefore the option value should be incorporated while valuing the business E. Efficient market requires that information should be available to all investors at a minimal cost Question 2: (2* 5 marks = 10 marks) A. You have been assigned to do the valuation of a few stocks listed on the London Stock exchange. How does your view on market efficiency affect your approach to valuation? B. De Cheers, a prominent gold mining company, seeks to value its undeveloped gold reserves. As of date, the gold prices are low, and extraction is expensive. Using the option pricing theory, explain how you will value this natural resource. Question 3: (3+3+ 4 = 10 marks) You are trying to estimate the free cash flow to the firm(FCFF) for Sterling a pharmaceutical firm. The firm reported $100million in earnings before interest and taxes. Additional capital expenditure of $45 million, an increase in non-cash working capital of $ 5million, and depreciation of 530 million were reported in the most recent year. The firm is financed with 60% debt. The company's bonds have B+ rating with a default spread of 2%. A ten-year government bond currently yields 1.4%, equity risk premium amounts to 5.6%. The stock returns are correlated 1.2 times with the market. The corporate tax rate is 35%. REQUIRED: A Calculate FCFF for the most recent year. B. Calculate FCFF for the next year. You may assume that the firm earns a retum on assets of 6% with a reinvestment rate of 40% C. Calculate the appropriate discount rate to be used in the valuation? 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts