Question: points) Jill needs to determine a beta for a private company for its valuation. She found a public comparable with a beta of 1.2. As

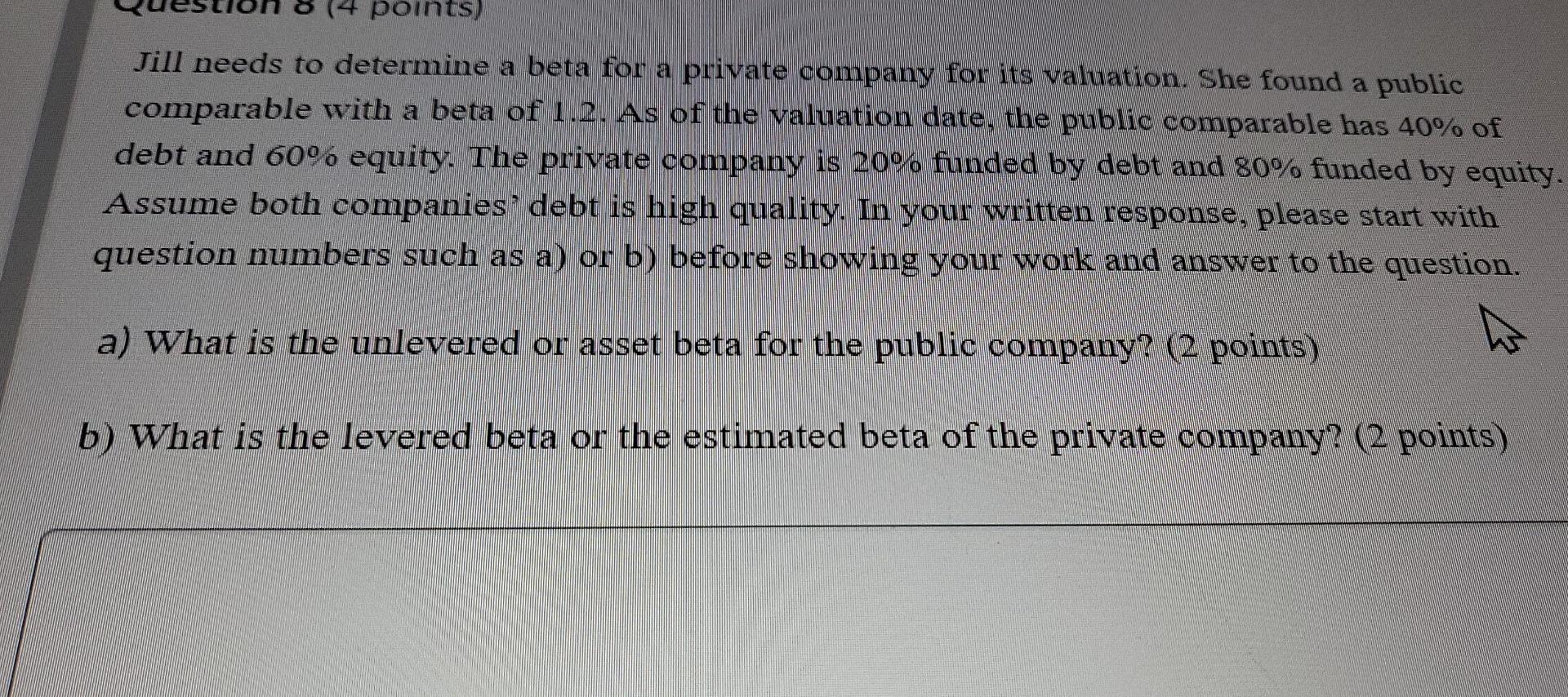

points) Jill needs to determine a beta for a private company for its valuation. She found a public comparable with a beta of 1.2. As of the valuation date, the public comparable has 40% of debt and 60% equity. The private company is 20% funded by debt and 80% funded by equity. Assume both companies' debt is high quality. In your written response, please start with question numbers such as a) or b) before showing your work and answer to the question. a) What is the unlevered or asset beta for the public company? (2 points) b) What is the levered beta or the estimated beta of the private company? (2 points)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock