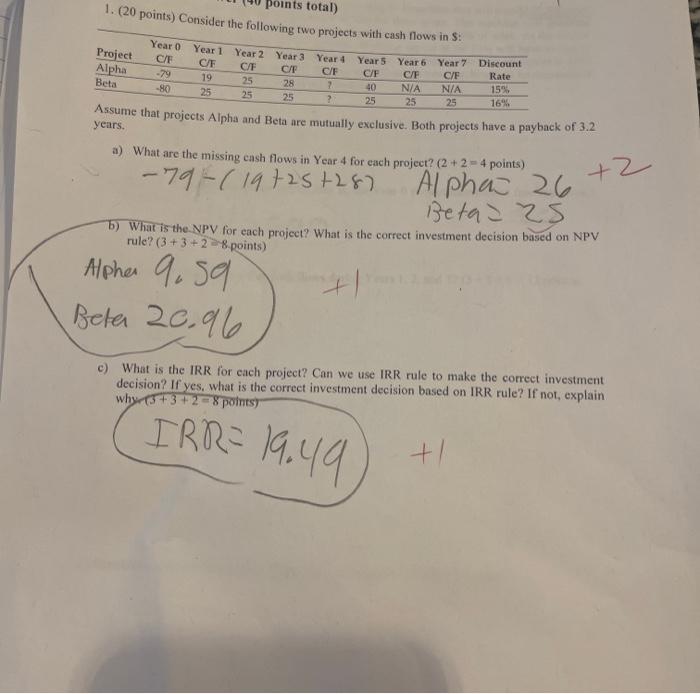

Question: points total) 1. (20 points) Consider the following two projects with cash flows in $: Project Alpha Beta Year 0 C/F -79 -80 Year 1

1. (20 points) Consider the followinatal) uat projects Alpha and Beta are mutually exclusive. Both projects have a payback of 3.2 a) What are the missing cash flows in Year 4 for each project? (2+2=4 points ) b) What is the. NPV for each project? What is the correct investment decision based on NPV rule? (3+3+2 i 8 points) Hpher c) What is the IRR for each project? Can we use IRR rule to make the correct investment decision? If yes, what is the correct investment decision based on IRR rule? If not, explain why (5+3+2=8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts