Question: Portfolio Analysis - Markowitz Bullet All Sections Developed by Nobel Laureate Harry Markowitz, modern portfolio theory is a widely used investing model designed to help

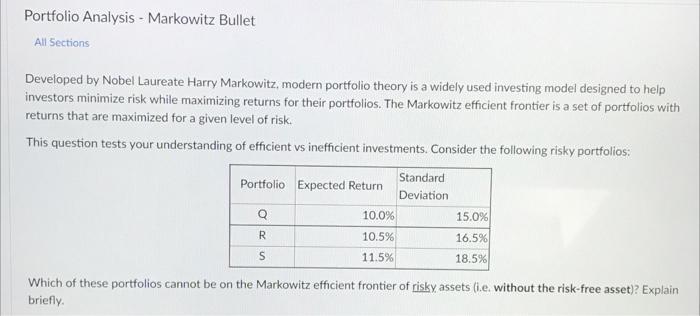

Portfolio Analysis - Markowitz Bullet All Sections Developed by Nobel Laureate Harry Markowitz, modern portfolio theory is a widely used investing model designed to help investors minimize risk while maximizing returns for their portfolios. The Markowitz efficient frontier is a set of portfolios with returns that are maximized for a given level of risk. This question tests your understanding of efficient vs inefficient investments. Consider the following risky portfolios: Standard Portfolio Expected Return Deviation Q 10.0% 15.0% R 10.5% 16.5% S 11.5% 18.5% Which of these portfolios cannot be on the Markowitz efficient frontier of risky assets (ie without the risk-free asset)? Explain briefly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts