Question: Portfolio analysis You have been given the expected return data shown in the first table on three assets - F,G, and H - over the

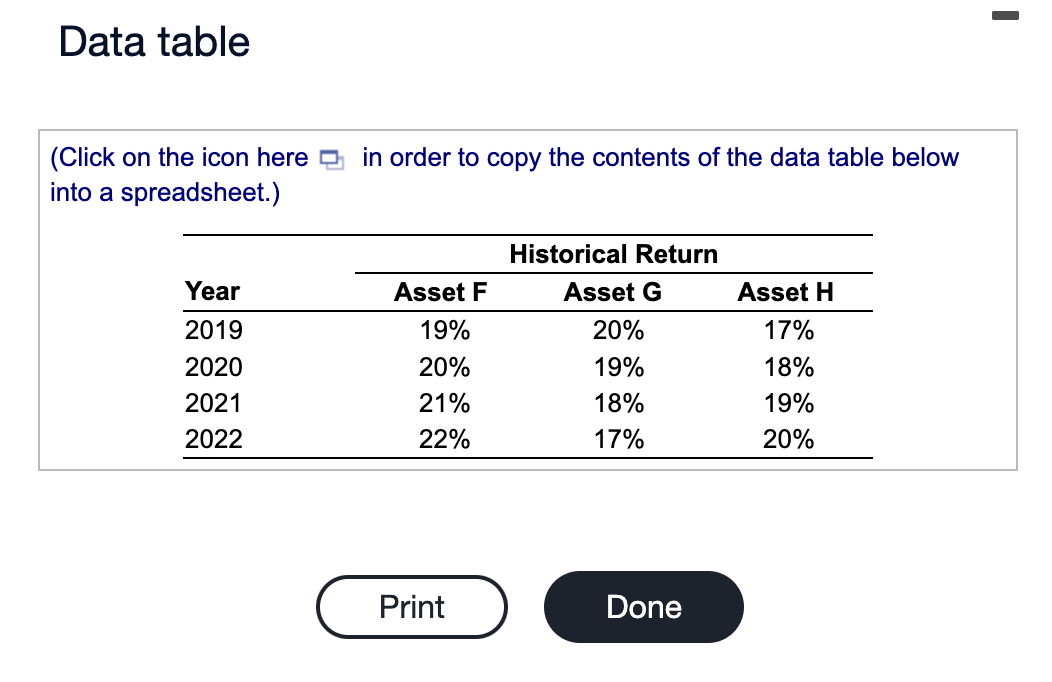

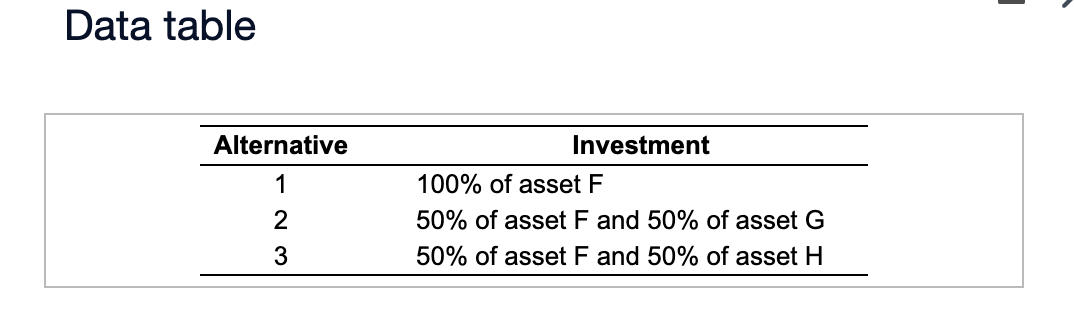

Portfolio analysis You have been given the expected return data shown in the first table on three assets - F,G, and H - over the period 2019-2022: Using these assets, you have isolated the three investment alternatives shown in the following table: a. Calculate the average return over the 4-year period for each of the three alternatives. b. Calculate the standard deviation of returns over the 4-year period for each of the three alternatives. c. Use your findings in parts a and b to calculate the coefficient of variation for each of the three alternatives. d. On the basis of vour findings, which of the three investment alternatives a. The expected return over the 4-year period for alternative 1 is %. (Round to two decimal place.) The expected return over the 4-year period for alternative 2 is %. (Round to two decimal place.) The expected return over the 4-year period for alternative 3 is %. (Round to two decimal place.) b. The standard deviation of returns over the 4-year period for alternative 1 is \%. (Round to two decimal places.) The standard deviation of returns over the 4-year period for alternative 2 is \%. (Round to two decimal places.) The standard deviation of returns over the 4-year period for alternative 3 is \%. (Round to two decimal places.) c. The coefficient of variation for alternative 1 is (Round to three decimal places.) The coefficient of variation for alternative 2 is (Round to three decimal places.) The coefficient of variation for alternative 3 is (Round to three decimal places.) d. On the basis of your findings, which of the three investment alternatives do you recommend? Why? Alternative 1 posted the highest return but Alternative 2 the lowest volatility (risk). When thinking about performance, it is instructive to ask how a hypothetical investor might view these alternatives. She would first note Alternative 2 is clearly preferable to Alternative 3 because it offers the same expected return but no volatility in returns. Now, as between Alternatives 1 and 2, Alternative 1 offers a higher expected return but also has more volatile returns. Without knowing an investor's risk tolerance, it is not possible to say whether Alternative 1 or 2 is "best." Is the previous statement True or False? (Select the best answer from the drop-down menu.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Data table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts