Question: i need help with putting formula in excel document... answers not coming out correct. Risk and the Required Rate of Return ART 4 a. Calculate

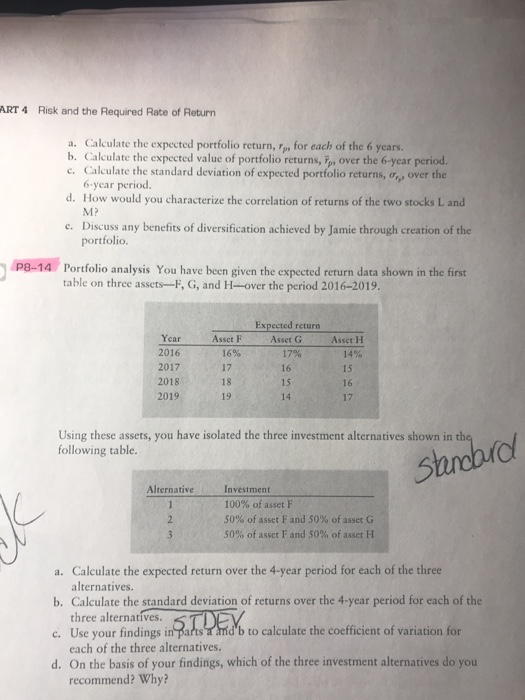

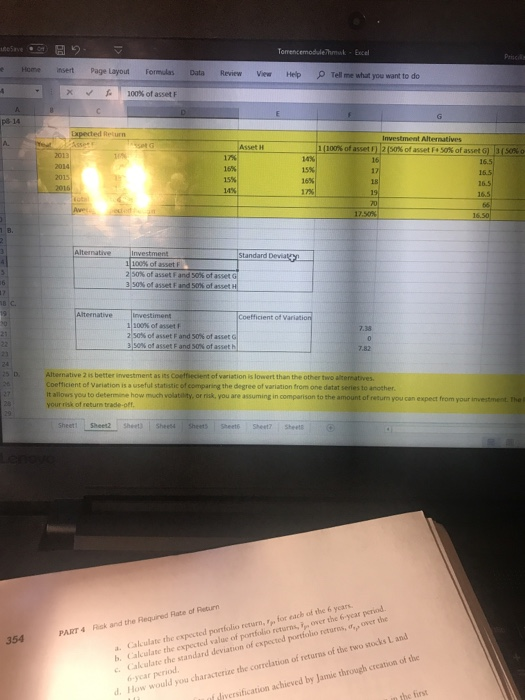

Risk and the Required Rate of Return ART 4 a. Calculate the expected portfolio return, p, for each of the 6 years. b. Calculate the expected value of portfolio returns, " over the 6-year period. c. Calculate the standard deviation of expected portfolio returns, a, over the 6-year period. d. How would you characterize the correlation of returns of the two stocks L and M? c. Discuss any benefits of diversification achieved by Jamie through creation of the portfolio P8-14 Portfolio analysis You have been given the expected return data shown in the first table on three assets-F, G, and H-over the period 2016-2019. Expected return Asset G Asset F 16% Asset H 2016 2017 2018 2019 14% 15 16 17 17% 16 15 14 18 19 Using these assets, you have isolated the three investment alternatives shown in following table. Alternative Investment 100% of asset F 50% of asset F and 50% of asset G 50% of asset F and 50% of asset H a. Calculate the expected return over the 4-year period for each of the three b. Calculate the standard deviation of returns over the 4-year period for each of the c. Use your findings in parts and'b to calculate the coefficient of variation for d. On the basis of your findings, which of the three investment alternatives do you alternatives three alternatives each of the three alternatives. recommend? Why? e Home Excel Page Layout Formulas Data Review View Hep Tell me whait you want to do ,00% of asset F 2013 1(100% of asset 112(50% of assetF450% ofasse glis0% o 13( 14% 16% 17 16% 100% of asset F 50% of asset and 50% of asset G 3.50% of asset F and 50% of asset H Alter 1 icient of Variation 100% of asset F 150% of asset F 3150% of asset and 50% of asset G 7.38 asset h 25 D Alternative 2 is better variation is lowert than the othes or risk, you are assuming in comparison to the of Variation is a useful statistic of comparing the degree of variation from one datat series to another It allows you to determine how much your risk of return trade-off volatility, of return you can expect from your investment Sheet! Sheet2 Sheet3 Shees4 SheetSheet?Sheet a. Calculate the expected portfolio return, p, for each of the 6 ycars b. Calculate the expected value of portfolio returns, i over the 6-ycar period. PART 4 Risk and the Required Rate of Return Calulate the standard deviation of expected portfolio returos, a, over the 6-ycar period 354 through creation of the How would you characterize the correlation of returns of the two stocks L and d. diversification achieved by Jamie he first

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts