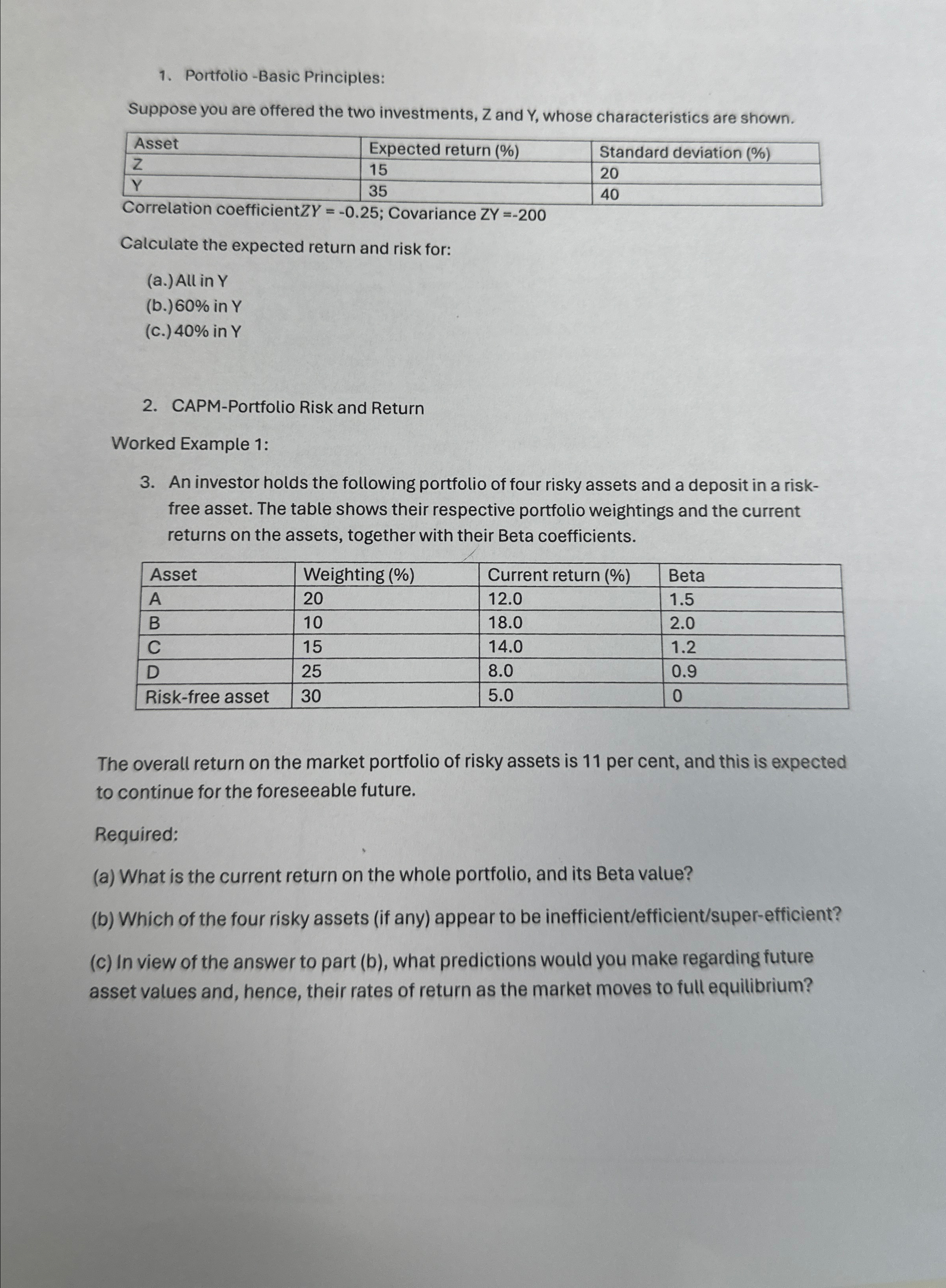

Question: Portfolio - Basic Principles: Suppose you are offered the two investments, Z and Y , whose characteristics are shown. table [ [ Asset ,

Portfolio Basic Principles:

Suppose you are offered the two investments, and whose characteristics are shown.

tableAssetExpected return Standard deviation

Correlation coefficient ; Covariance

Calculate the expected return and risk for:

a All in

b in

c in

CAPMPortfolio Risk and Return

Worked Example :

An investor holds the following portfolio of four risky assets and a deposit in a riskfree asset. The table shows their respective portfolio weightings and the current returns on the assets, together with their Beta coefficients.

tableAssetWeighting Current return BetaABCDRiskfree asset,

The overall return on the market portfolio of risky assets is per cent, and this is expected to continue for the foreseeable future.

Required:

a What is the current return on the whole portfolio, and its Beta value?

b Which of the four risky assets if any appear to be inefficientefficientsuperefficient?

c In view of the answer to part b what predictions would you make regarding future asset values and, hence, their rates of return as the market moves to full equilibrium?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock