Question: Portfolio Choice (10 points) Consider two securities A and B with mean returns A = 15% and 4b = 12%. Their volailities are OA =

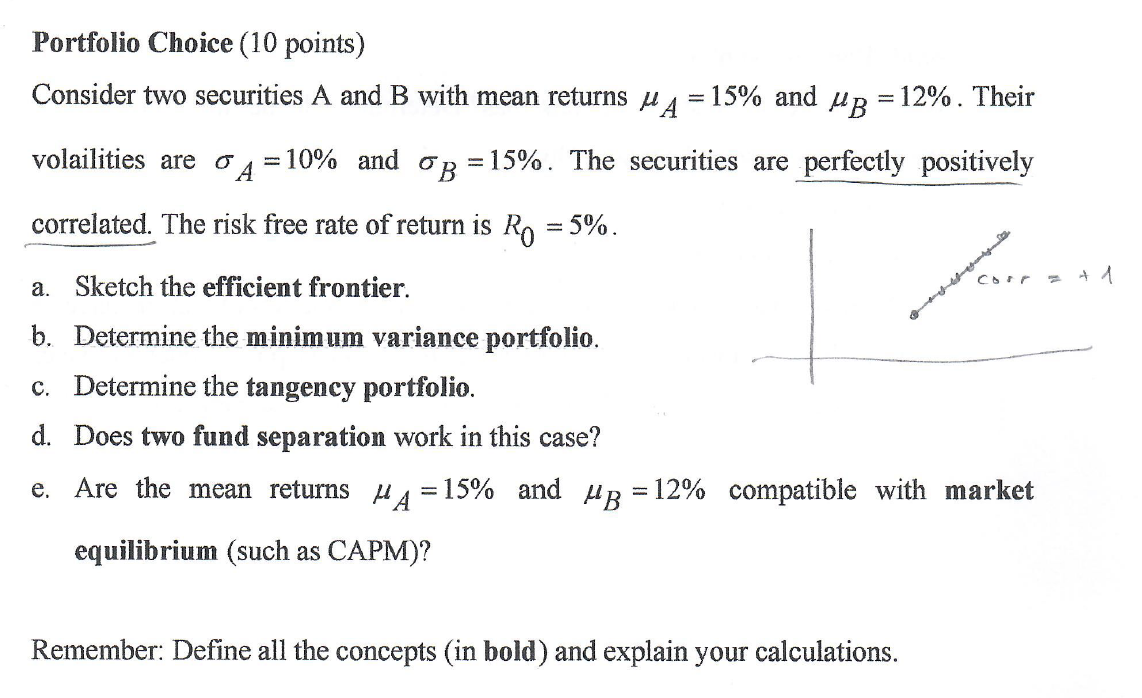

Portfolio Choice (10 points) Consider two securities A and B with mean returns A = 15% and 4b = 12%. Their volailities are OA = 10% and op = 15%. The securities are perfectly positively correlated. The risk free rate of return is Ro = 5%. barna a. Sketch the efficient frontier. b. Determine the minimum variance portfolio. c. Determine the tangency portfolio. d. Does two fund separation work in this case? e. Are the mean returns HA = 15% and HB = 12% compatible with market equilibrium (such as CAPM)? Remember: Define all the concepts (in bold) and explain your calculations. Portfolio Choice (10 points) Consider two securities A and B with mean returns A = 15% and 4b = 12%. Their volailities are OA = 10% and op = 15%. The securities are perfectly positively correlated. The risk free rate of return is Ro = 5%. barna a. Sketch the efficient frontier. b. Determine the minimum variance portfolio. c. Determine the tangency portfolio. d. Does two fund separation work in this case? e. Are the mean returns HA = 15% and HB = 12% compatible with market equilibrium (such as CAPM)? Remember: Define all the concepts (in bold) and explain your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts