Question: PORTFOLIO MANAGEMENT 1. Below are three stocks whose expected returns and standard deviation details are given: Stocks Expected Return Standard Deviation IndiCome Limited 18% 20%

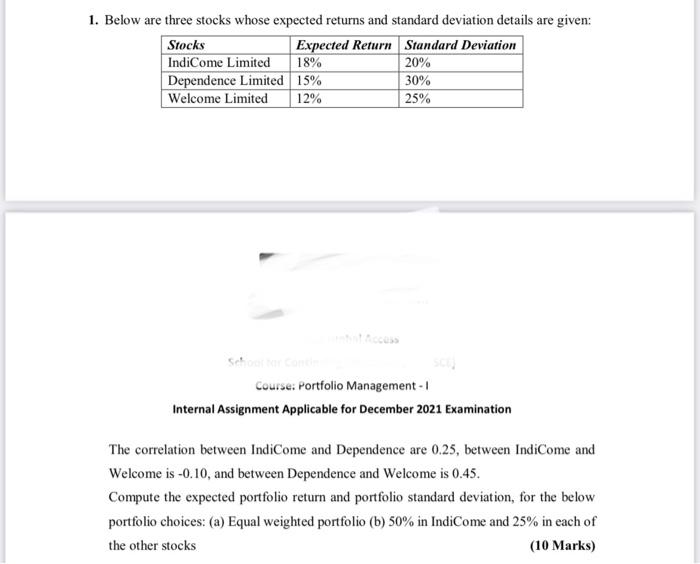

1. Below are three stocks whose expected returns and standard deviation details are given: Stocks Expected Return Standard Deviation IndiCome Limited 18% 20% Dependence Limited 15% 30% Welcome Limited 12% 25% 000 Course: Portfolio Management - Internal Assignment Applicable for December 2021 Examination The correlation between IndiCome and Dependence are 0.25, between IndiCome and Welcome is -0.10, and between Dependence and Welcome is 0.45. Compute the expected portfolio return and portfolio standard deviation, for the below portfolio choices: (a) Equal weighted portfolio (b) 50% in IndiCome and 25% in each of the other stocks (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts