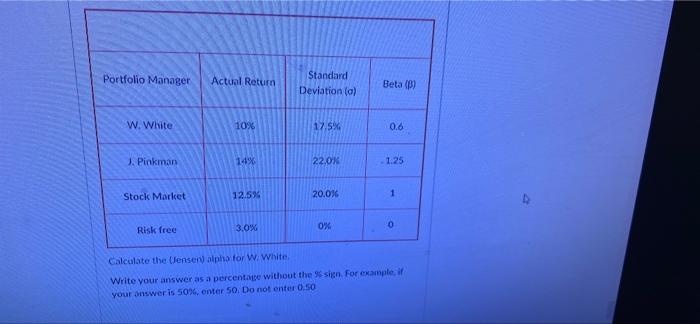

Question: Portfolio Manager Actual Return Standard Deviation o) Beta (B) W. White 10% 17.5% 0.6 3. Pinkman 14% 22.0% 1.25 Stock Market 12.594 20.0% 1 Risk

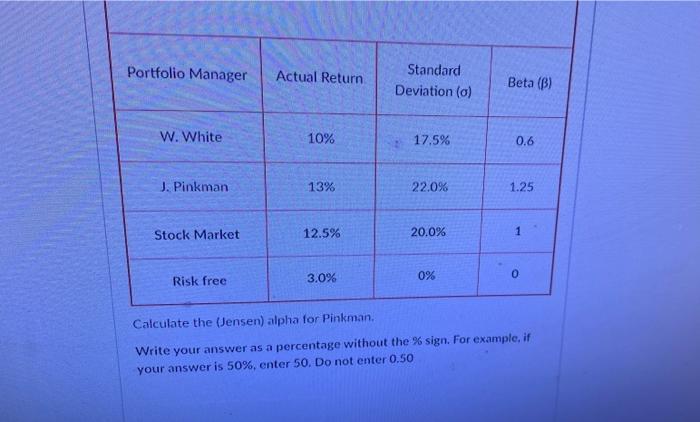

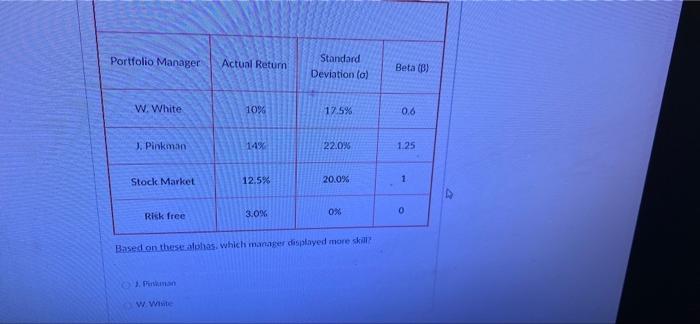

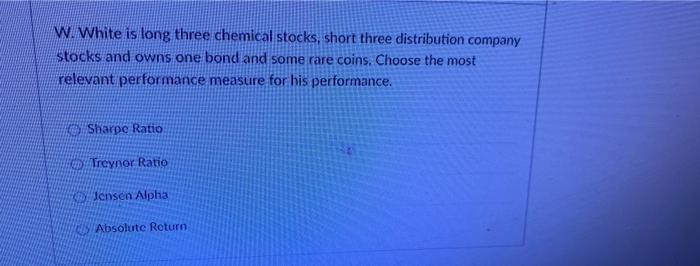

Portfolio Manager Actual Return Standard Deviation o) Beta (B) W. White 10% 17.5% 0.6 3. Pinkman 14% 22.0% 1.25 Stock Market 12.594 20.0% 1 Risk free 3.0% 0% 0 Calculate the (Jensen alpha for W. White Write your answer as a percentage without the sign. For example, if your answer is 5094, enter 50. Do not enter 0.50 Portfolio Manager Actual Return Standard Deviation (0) Beta (B) W. White 10% 17.5% 0.6 J. Pinkman 13% 22.0% 1.25 Stock Market 12.5% 20.0% 1 3.0% 0% 0 Risk free Calculate the (Jensen) alpha for Pinkman. Write your answer as a percentage without the % sign. For example, if your answer is 50%, enter 50. Do not enter 0.50 Portfolio Manager Actual Return Standard Deviation (o) Beta (6) W. White 1094 17.5% 0.6 J. Pinkman 14% 22.0% 1.25 Stock Market 12.5% 20.0% 1 3.0% 0% 0 Risk free Based on these alohas, which manager displayed more skirt W. We W.White is long three chemical stocks, short three distribution company stocks and owns one bond and some rare coins. Choose the most relevant performance measure for his performance. Sharpe Ratio Treynor Ratio Jensen Alpha Absolute Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts