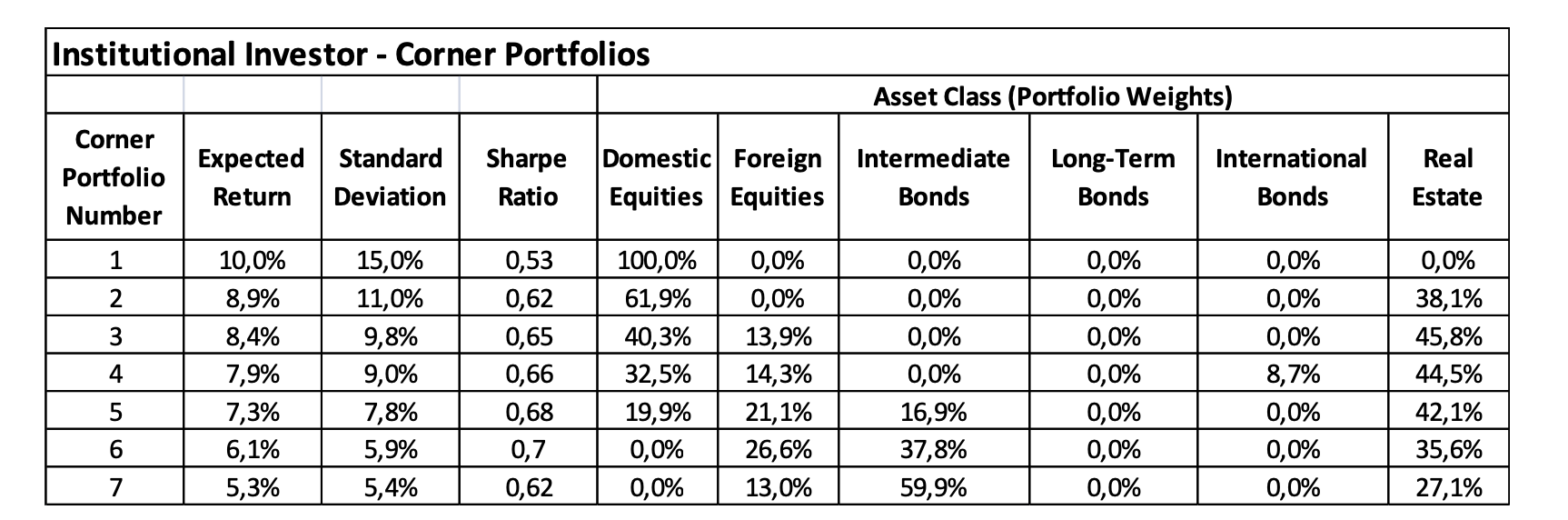

Question: Portfolio Optimization- Asset Allocation Using the information given above, answer the following questions: What is the maximum weight of foreign equities in any portfolio on

Portfolio Optimization- Asset Allocation

Using the information given above, answer the following questions:

-

What is the maximum weight of foreign equities in any portfolio on the efficient frontier?

-

What are the asset class weights in an efficient portfolio with an expected return of 6.5 percent?

-

Which asset class is most important in the 6.5 percent expected-return efficient portfolio? Explain.

Institutional Investor - Corner Portfolios Asset Class (Portfolio Weights) Real Corner Portfolio Number Expected Standard Return Deviation Sharpe Ratio Domestic Foreign Equities Equities Intermediate Bonds Long-Term Bonds International Bonds Estate 1 2 3 4 10,0% 8,9% 8,4% 7,9% 7,3% 6,1% 5,3% 15,0% 11,0% 9,8% 9,0% 7,8% 5,9% 5,4% 0,53 0,62 0,65 0,66 0,68 0,7 0,62 100,0% 61,9% 40,3% 32,5% 19,9% 0,0% 0,0% 0,0% 0,0% 13,9% 14,3% 21,1% 26,6% 13,0% 0,0% 0,0% 0,0% 0,0% 16,9% 37,8% 59,9% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 8,7% 0,0% 0,0% 0,0% 0,0% 38,1% 45,8% 44,5% 42,1% 35,6% 27,1% 5 7 Institutional Investor - Corner Portfolios Asset Class (Portfolio Weights) Real Corner Portfolio Number Expected Standard Return Deviation Sharpe Ratio Domestic Foreign Equities Equities Intermediate Bonds Long-Term Bonds International Bonds Estate 1 2 3 4 10,0% 8,9% 8,4% 7,9% 7,3% 6,1% 5,3% 15,0% 11,0% 9,8% 9,0% 7,8% 5,9% 5,4% 0,53 0,62 0,65 0,66 0,68 0,7 0,62 100,0% 61,9% 40,3% 32,5% 19,9% 0,0% 0,0% 0,0% 0,0% 13,9% 14,3% 21,1% 26,6% 13,0% 0,0% 0,0% 0,0% 0,0% 16,9% 37,8% 59,9% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 8,7% 0,0% 0,0% 0,0% 0,0% 38,1% 45,8% 44,5% 42,1% 35,6% 27,1% 5 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts