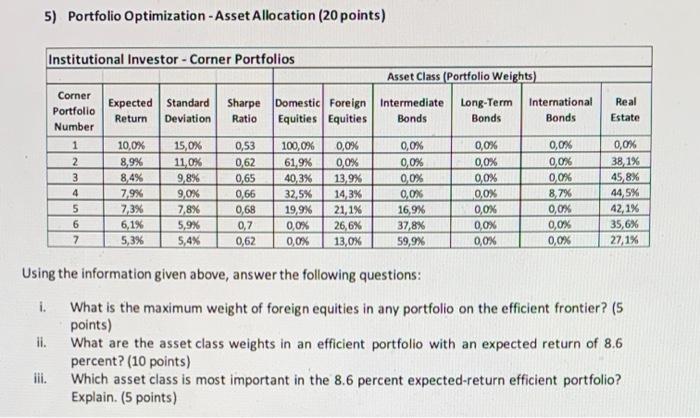

Question: 5) Portfolio Optimization - Asset Allocation (20 points) Real Estate Institutional Investor - Corner Portfolios Asset Class (Portfolio Weights) Corner Expected Standard Portfolio Sharpe Domestic

5) Portfolio Optimization - Asset Allocation (20 points) Real Estate Institutional Investor - Corner Portfolios Asset Class (Portfolio Weights) Corner Expected Standard Portfolio Sharpe Domestic Foreign Intermediate Long-Term International Return Deviation Ratio Equities Equities Bonds Number Bonds Bonds 1 10,0% 15,0% 0,53 100,0% 0,0% 0,0% 0,0% 0,0% 2 8,9% 11,0% 0,62 61.9% 0,0% 0,0% 0,0% 0,0% 3 8.4% 9,8% 0,65 40,3% 13,9% 0,0% 0,0% 0,0% 4 7,9% 9,0% 0,66 32,5% 14,3% 0,0% 0,0% 8.7% 5 7,3% 7,8% 0,68 19,9% 21,1% 16,9% 0,0% 0,0% 6 6,1% 5,9% 0,7 0,0% 26,6% 37,8% 0,0% 0,0% 7 5,3% 5,4% 0,62 0,0% 13,0% 59,9% 0,0% 0,0% 0,0% 38.1% 45,8% 44,5% 42,1% 35,6% 27.1% Using the information given above, answer the following questions: i. What is the maximum weight of foreign equities in any portfolio on the efficient frontier? (5 points) ii. What are the asset class weights in an efficient portfolio with an expected return of 8.6 percent? (10 points) iii. Which asset class is most important in the 8.6 percent expected-return efficient portfolio? Explain. (5 points) 5) Portfolio Optimization - Asset Allocation (20 points) Real Estate Institutional Investor - Corner Portfolios Asset Class (Portfolio Weights) Corner Expected Standard Portfolio Sharpe Domestic Foreign Intermediate Long-Term International Return Deviation Ratio Equities Equities Bonds Number Bonds Bonds 1 10,0% 15,0% 0,53 100,0% 0,0% 0,0% 0,0% 0,0% 2 8,9% 11,0% 0,62 61.9% 0,0% 0,0% 0,0% 0,0% 3 8.4% 9,8% 0,65 40,3% 13,9% 0,0% 0,0% 0,0% 4 7,9% 9,0% 0,66 32,5% 14,3% 0,0% 0,0% 8.7% 5 7,3% 7,8% 0,68 19,9% 21,1% 16,9% 0,0% 0,0% 6 6,1% 5,9% 0,7 0,0% 26,6% 37,8% 0,0% 0,0% 7 5,3% 5,4% 0,62 0,0% 13,0% 59,9% 0,0% 0,0% 0,0% 38.1% 45,8% 44,5% 42,1% 35,6% 27.1% Using the information given above, answer the following questions: i. What is the maximum weight of foreign equities in any portfolio on the efficient frontier? (5 points) ii. What are the asset class weights in an efficient portfolio with an expected return of 8.6 percent? (10 points) iii. Which asset class is most important in the 8.6 percent expected-return efficient portfolio? Explain. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts