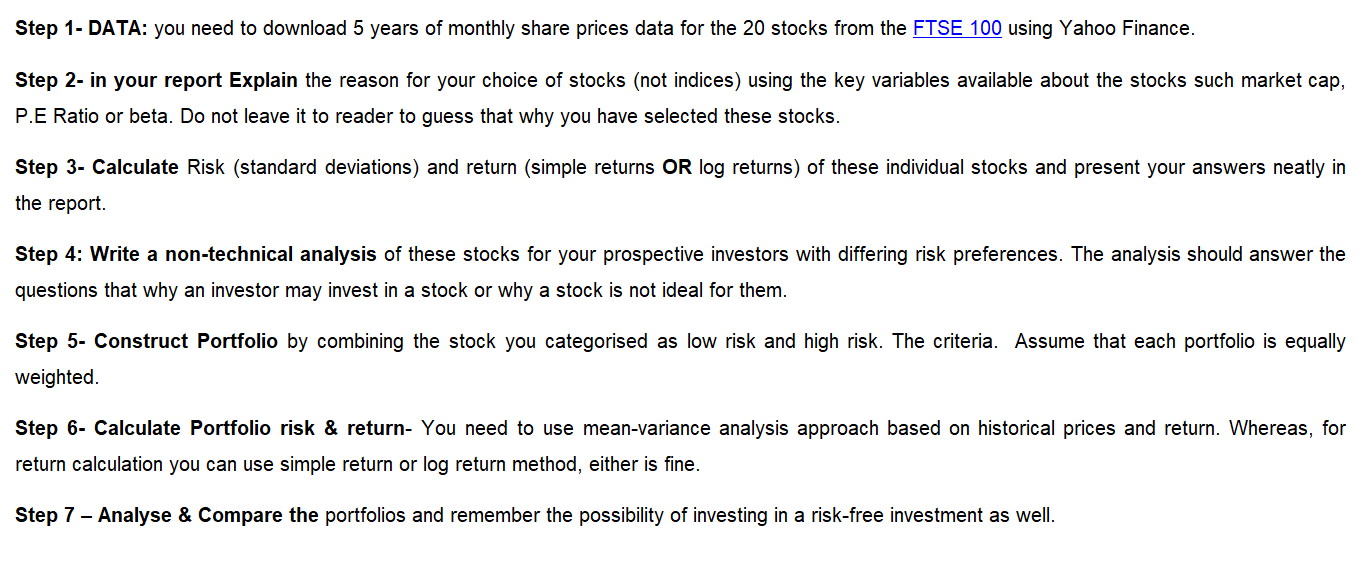

Question: Portfolio Risk and Return Analysis Construct a high risk and a low risk by allocating equal weights to each stock you have identified in the

- Portfolio Risk and Return Analysis

- Construct a high risk and a low risk by allocating equal weights to each stock you have identified in the previous question (1.b).

- Report on the risk and return of each of the portfolios you have constructed in part a of this question including an assessment of their suitability for investors with varying degree of risk preferences (you may assume that investors also can invest in a risk-free asset).

- Provide a reflective summary of your understanding of portfolio management theory and practice. Use lessons from the exercises you have done in previous sections.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock