Question: (Portfolio selection problem) Daniel Grady is the financial advisor for a number of professional ath- letes. An analysis of the long-term goals for many of

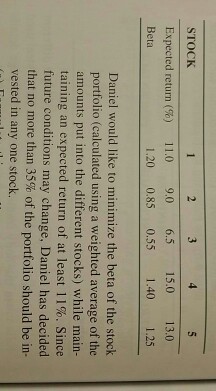

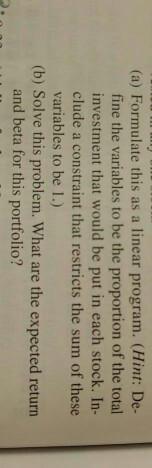

(Portfolio selection problem) Daniel Grady is the financial advisor for a number of professional ath- letes. An analysis of the long-term goals for many of these athletes has resulted in a recommendation to purchase stocks with some of their income that is set aside for investments. Five stocks have been identified as having very favorable expectations for future performance. Although the expected return is important in these investments, the risk, as measured by the beta of the stock, is also important. (A high value of beta indicates that the stock has a relatively high risk.) The expected return and the betas for five stocks are as follows: 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts