Question: PORTFOLIO THEORY, where r is return vector, S is covariance matrix. DETAILED SOLUTION to D, E, F, G please A 3-asset Markowitz portfolio has the

PORTFOLIO THEORY, where r is return vector, S is covariance matrix.

DETAILED SOLUTION to D, E, F, G please

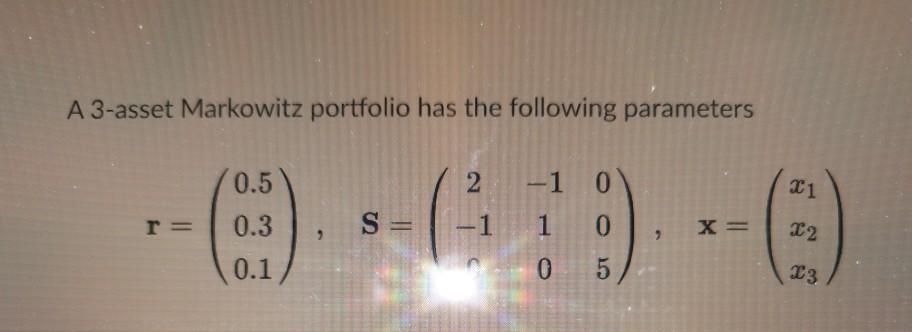

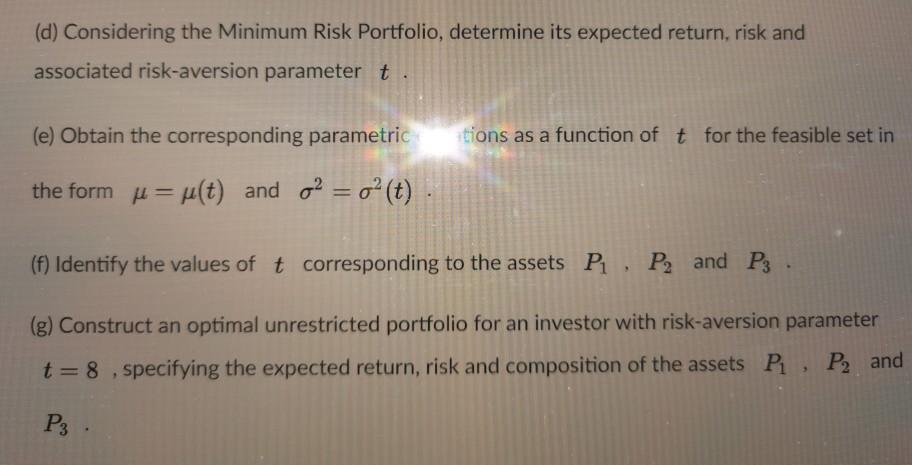

A 3-asset Markowitz portfolio has the following parameters 0.5 21 T= 0.3 S = 2 -1 0 1 1 0 0 5 X= 22 0.1 23 (d) Considering the Minimum Risk Portfolio, determine its expected return, risk and associated risk-aversion parameter t (e) Obtain the corresponding parametric tions as a function of t for the feasible set in the form u= u(t) and o2 = o(t) (f) Identify the values of t corresponding to the assets P . P and P3 (g) Construct an optimal unrestricted portfolio for an investor with risk-aversion parameter t=8 , specifying the expected return, risk and composition of the assets P1, P2 and P3 A 3-asset Markowitz portfolio has the following parameters 0.5 21 T= 0.3 S = 2 -1 0 1 1 0 0 5 X= 22 0.1 23 (d) Considering the Minimum Risk Portfolio, determine its expected return, risk and associated risk-aversion parameter t (e) Obtain the corresponding parametric tions as a function of t for the feasible set in the form u= u(t) and o2 = o(t) (f) Identify the values of t corresponding to the assets P . P and P3 (g) Construct an optimal unrestricted portfolio for an investor with risk-aversion parameter t=8 , specifying the expected return, risk and composition of the assets P1, P2 and P3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts