Question: Positive feedback instantly for correct answer. thanks QUESTION 3 Printer Leases, Inc. (accrual basis taxpayer) leased a printer to Elaine on 12/29/21. The printer was

Positive feedback instantly for correct answer. thanks

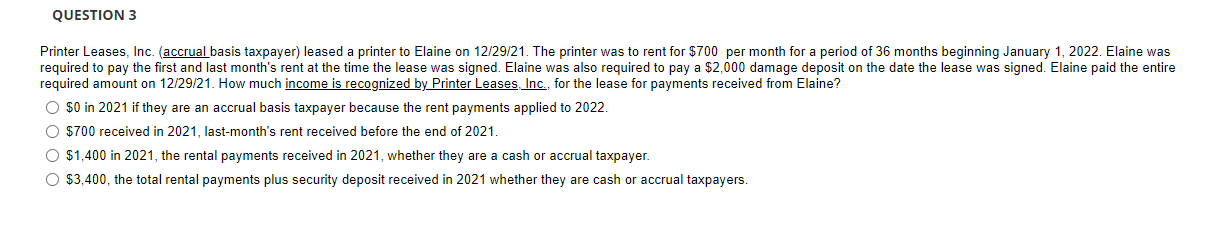

QUESTION 3 Printer Leases, Inc. (accrual basis taxpayer) leased a printer to Elaine on 12/29/21. The printer was to rent for $700 per month for a period of 36 months beginning January 1, 2022. Elaine was required to pay the first and last month's rent at the time the lease was signed. Elaine was also required to pay a $2,000 damage deposit on the date the lease was signed. Elaine paid the entire required amount on 12/29/21. How much income is recognized by Printer Leases, Inc., for the lease for payments received from Elaine? $0 in 2021 if they are an accrual basis taxpayer because the rent payments applied to 2022. O $700 received in 2021, last-month's rent received before the end of 2021. $1,400 in 2021, the rental payments received in 2021, whether they are a cash or accrual taxpayer. $3,400, the total rental payments plus security deposit received in 2021 whether they are cash or accrual taxpayers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts