Question: Post 6 . 2 : Notes Receivable On December 3 1 , 2 0 2 5 , Oakbrook Inc. rendered services to Beghun Corporation at

Post : Notes Receivable

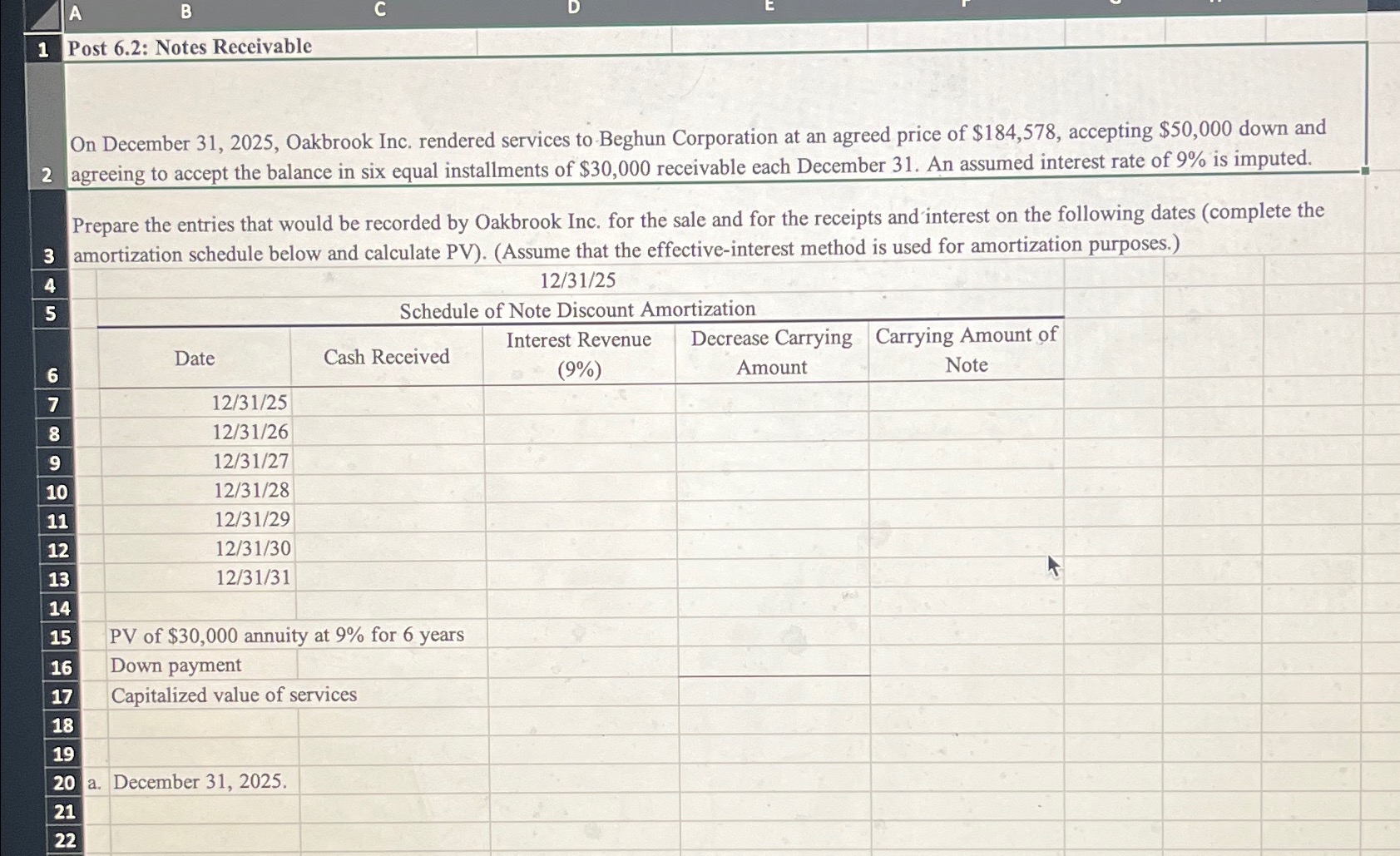

On December Oakbrook Inc. rendered services to Beghun Corporation at an agreed price of $ accepting $ down and agreeing to accept the balance in six equal installments of $ receivable each December An assumed interest rate of is imputed.

Prepare the entries that would be recorded by Oakbrook Inc. for the sale and for the receipts and interest on the following dates complete the amortization schedule below and calculate PVAssume that the effectiveinterest method is used for amortization purposes.

Schedule of Note Discount Amortization

tableDateCash Received,tableInterest Revenue

Post : Notes Receivable

On December Oakbrook Inc. rendered services to Beghun Corporation at an agreed price of $ accepting $ down and agreeing to accept the balance in six equal installments of $ receivable each December An assumed interest rate of is imputed.

Prepare the entries that would be recorded by Oakbrook Inc. for the sale and for the receipts and interest on the following dates complete the amortization schedule below and calculate PVAssume that the effectiveinterest method is used for amortization purposes.

tablenSchedul,f Note Discount rtization,Date,Cash Received,tableInterest Revenue

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock