Question: Post 86% 20:02 Read Only - You can't save changes to t... 9. The decision in Myer leads to the principle that ordinary income: A.

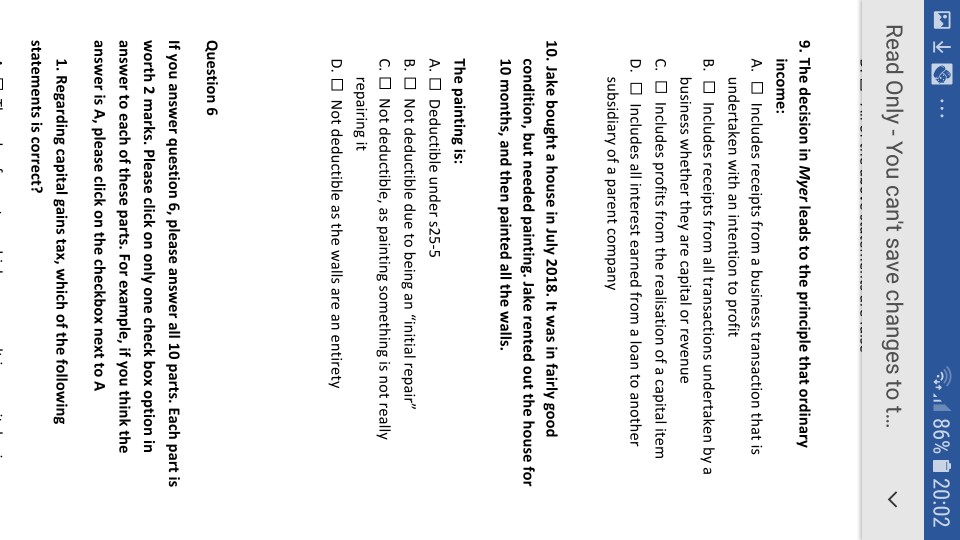

Post 86% 20:02 Read Only - You can't save changes to t... 9. The decision in Myer leads to the principle that ordinary income: A. Includes receipts from a business transaction that is undertaken with an intention to profit B. O Includes receipts from all transactions undertaken by a business whether they are capital or revenue C. Includes profits from the realisation of a capital item D. Includes all interest earned from a loan to another subsidiary of a parent company 10. Jake bought a house in July 2018. It was in fairly good condition, but needed painting. Jake rented out the house for 10 months, and then painted all the walls. The painting is: A. Deductible under 25-5 B. O Not deductible due to being an "initial repair" C. O Not deductible, as painting something is not really repairing it D. O Not deductible as the walls are an entirety Question 6 If you answer question 6, please answer all 10 parts. Each part is worth 2 marks. Please click on only one check box option in answer to each of these parts. For example, if you think the answer is A, please click on the checkbox next to A 1. Regarding capital gains tax, which of the following statements is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts