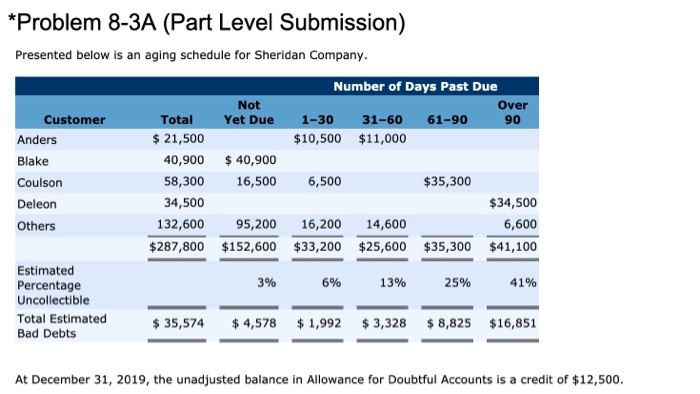

Question: post adjusting entry for bad debts at December 32. 2019 *Problem 8-3A (Part Level Submission) Presented below is an aging schedule for Sheridan Company. Number

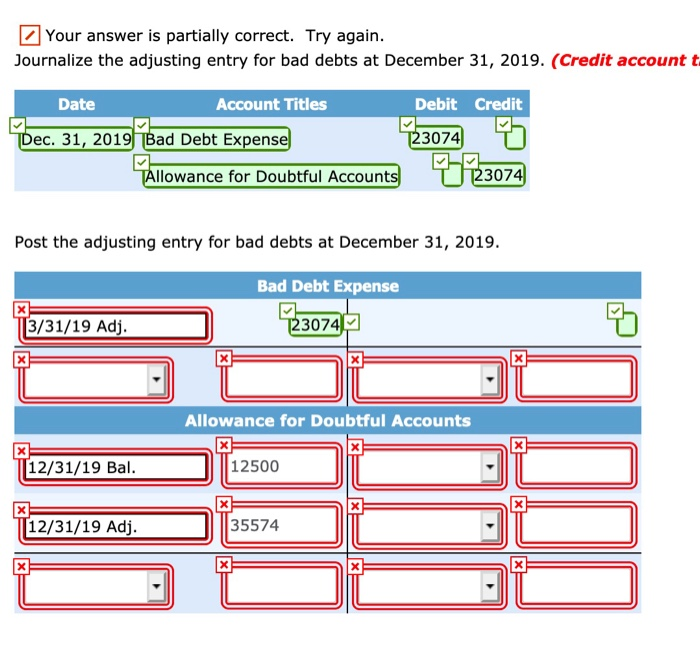

*Problem 8-3A (Part Level Submission) Presented below is an aging schedule for Sheridan Company. Number of Days Past Due Not Over Customer Total Yet Due 1-30 31-60 61-90 90 Anders $ 21,500 $10,500 $11,000 Blake 40,900 $ 40,900 Coulson 58,300 16,500 6,500 $35,300 Deleon 34,500 $34,500 Others 132,600 95,200 16,200 14,600 6,600 $287,800 $152,600 $33,200 $25,600 $35,300 $41,100 Estimated Percentage 3% 13% 41% Uncollectible Total Estimated $ 35,574 $ 4,578 $ 1,992 $3,328 $8,825 $16,851 Bad Debts 6% 25% At December 31, 2019, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $12,500. Your answer is partially correct. Try again. Journalize the adjusting entry for bad debts at December 31, 2019. (Credit account t Date Account Titles Debit Credit Dec. 31, 2019 Bad Debt Expense 123074 Allowance for Doubtful Accounts 123074 Post the adjusting entry for bad debts at December 31, 2019. Bad Debt Expense X (3/31/19 Adj. 123074, 3 X Allowance for Doubtful Accounts X 12/31/19 Bal. 12500 X x X 12/31/19 Adj. 35574 DOO X 3/31/19 Adj. 5/31/19 Adj. 12/31/19 Adj. 12/31/19 Bal. 3/31/20 5/31/20 12/31/20 Adj. 12/31/20 Bal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts