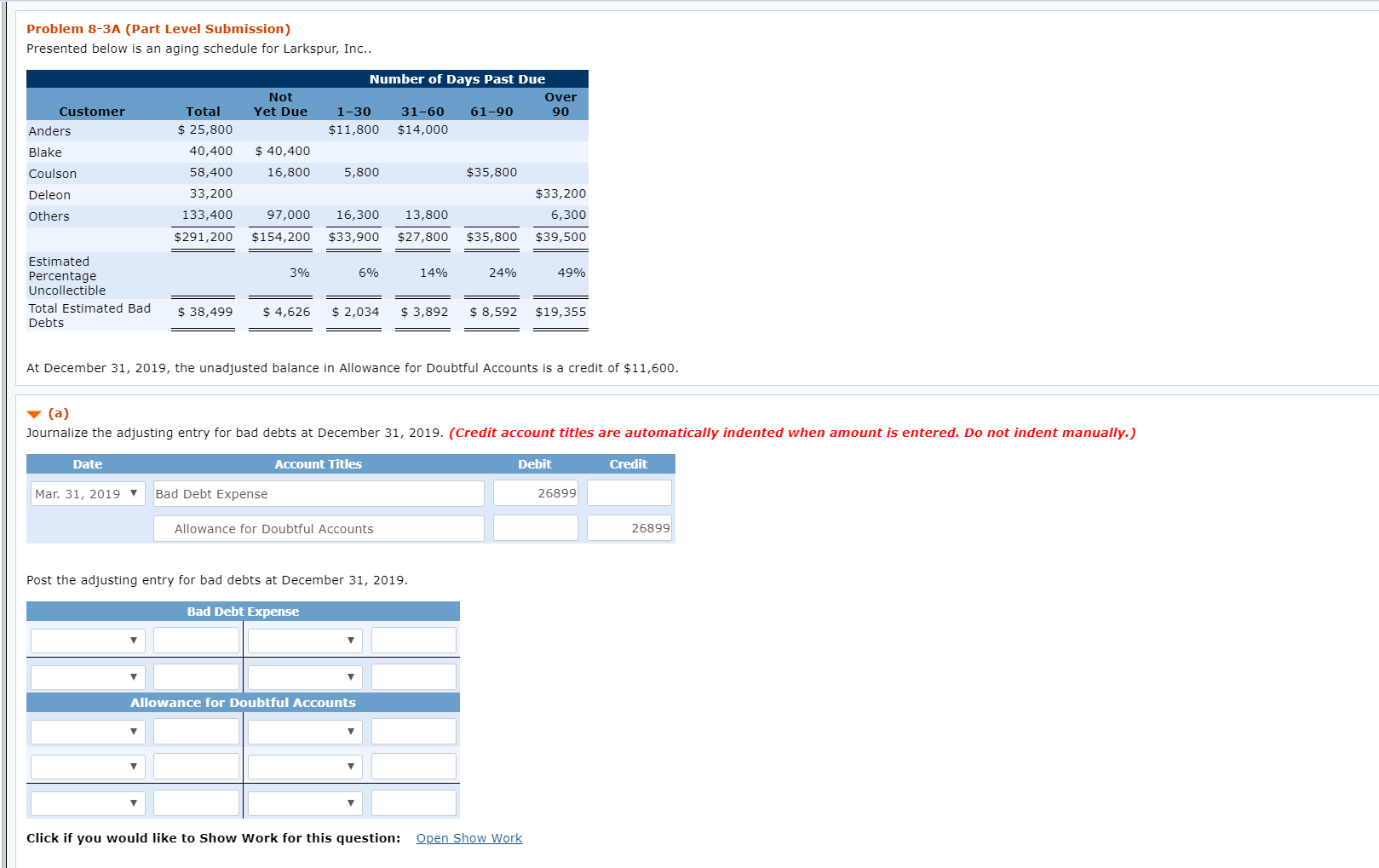

Question: Problem 8-3A (Part Level Submission) Presented below is an aging schedule for Larkspur, Inc.. Not Yet Due Number of Days Past Due Over 1-3031-60 61-90

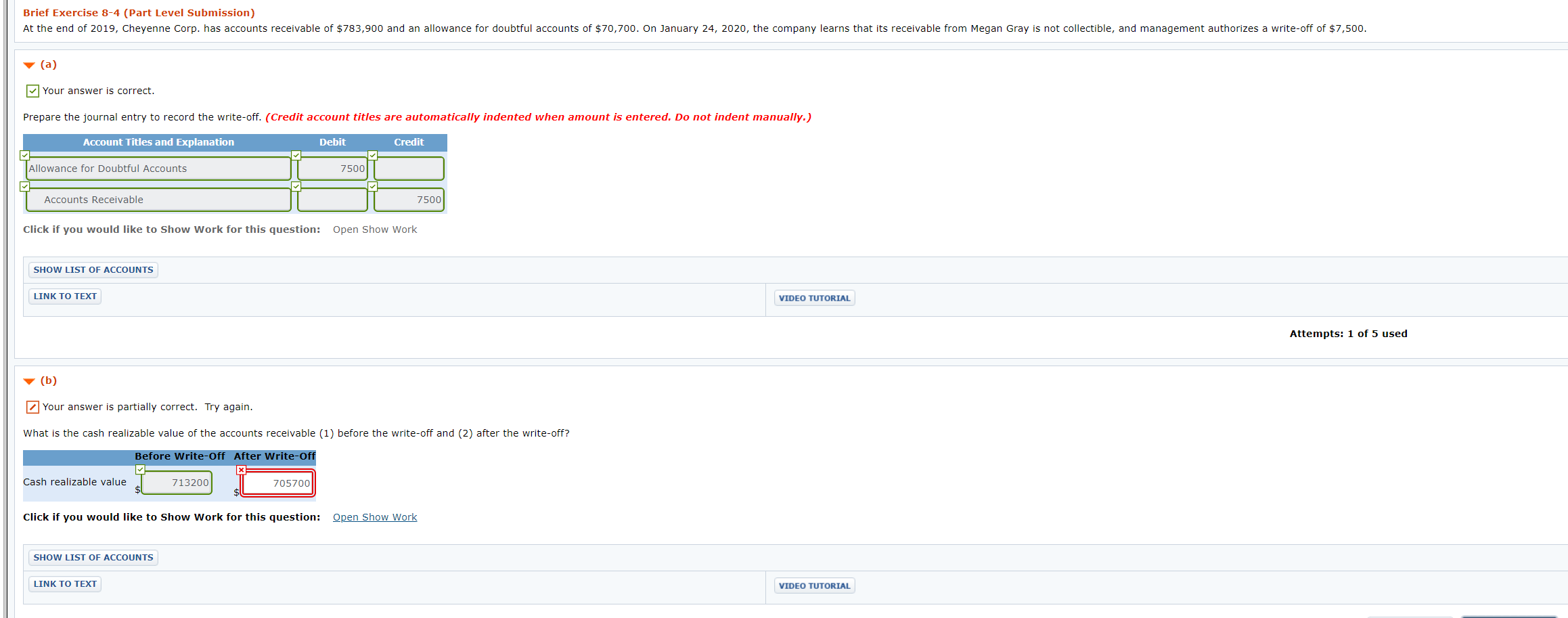

Problem 8-3A (Part Level Submission) Presented below is an aging schedule for Larkspur, Inc.. Not Yet Due Number of Days Past Due Over 1-3031-60 61-90 90 $11,800 $14,000 Customer Anders Blake Coulson Deleon Others Total $ 25,800 40,400 58,400 33,200 133,400 $291,200 $ 40,400 16,800 5,800 $35,800 97,000 $154,200 16,300 $33,900 13,800 $27,800 $33,200 6,300 $39,500 $35,800 3% 6% 14% 24% 49% Estimated Percentage Uncollectible Total Estimated Bad Debts $ 38,499 5453 3204 33.00 sasa1925 $ 4,626 $ 2,034 $ 3,892 $ 8,592 $19,355 At December 31, 2019, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $11,600. (a) Journalize the adjusting entry for bad debts at December 31, 2019. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles Debit Credit Mar. 31, 2019 Bad Debt Expense 26899 Allowance for Doubtful Accounts 26899 Post the adjusting entry for bad debts at December 31, 2019. Bad Debt Expense Allowance for Doubtful Accounts Click if you would like to show Work for this question: Open Show Work Brief Exercise 8-4 (Part Level Submission) At the end of 2019, Cheyenne Corp. has accounts receivable of $783,900 and an allowance for doubtful accounts of $70,700. On January 24, 2020, the company learns that its receivable from Megan Gray is not collectible, and management authorizes a write-off of $7,500. (a) your answer is correct. Prepare the journal entry to record the write-off. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Allowance for Doubtful Accounts 7500 IL Accounts Receivable 7500 Click if you would like to show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT VIDEO TUTORIAL Attempts: 1 of 5 used (b) Your answer is partially correct. Try again. What is the cash realizable value of the accounts receivable (1) before the write-off and (2) after the write-off? Before Write-Off After Write-off Cash realizable value 713200 705700 Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT VIDEO TUTORIAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts