Question: post excel sheet & formulas used please Re-evaluate the project in problem 2, but assume the equipment can be straight line depreciated over the 10

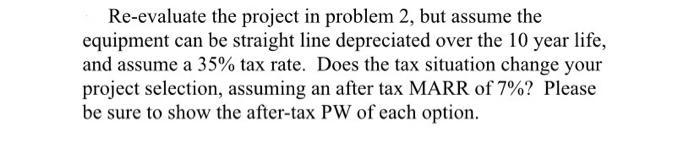

Re-evaluate the project in problem 2, but assume the equipment can be straight line depreciated over the 10 year life, and assume a 35% tax rate. Does the tax situation change your project selection, assuming an after tax MARR of 7%? Please be sure to show the after-tax PW of each option. Re-evaluate the project in problem 2, but assume the equipment can be straight line depreciated over the 10 year life, and assume a 35% tax rate. Does the tax situation change your project selection, assuming an after tax MARR of 7%? Please be sure to show the after-tax PW of each option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts