Question: post excel sheet & formulas used Re-evaluate the project in problem 2, but assume the equipment can be straight line depreciated over the 10 year

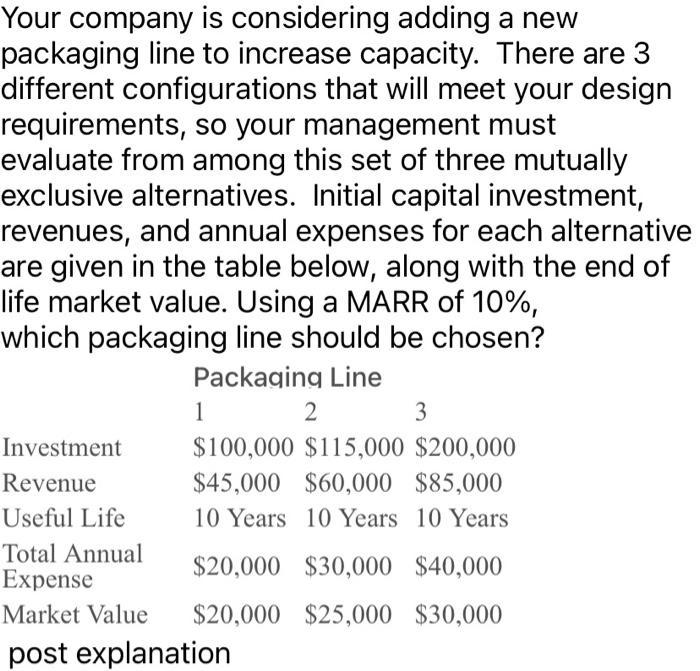

Re-evaluate the project in problem 2, but assume the equipment can be straight line depreciated over the 10 year life, and assume a 35% tax rate. Does the tax situation change your project selection, assuming an after tax MARR of 7%? Please be sure to show the after-tax PW of each option. Your company is considering adding a new packaging line to increase capacity. There are 3 different configurations that will meet your design requirements, so your management must evaluate from among this set of three mutually exclusive alternatives. Initial capital investment, revenues, and annual expenses for each alternative are given in the table below, along with the end of life market value. Using a MARR of 10%, which packaging line should be chosen? Packaging Line 1 2 3 Investment $100,000 $115,000 $200,000 Revenue $45,000 $60,000 $85,000 Useful Life 10 Years 10 Years 10 Years Total Annual Expense $20,000 $30,000 $40,000 Market Value $20,000 $25,000 $30,000 post explanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts