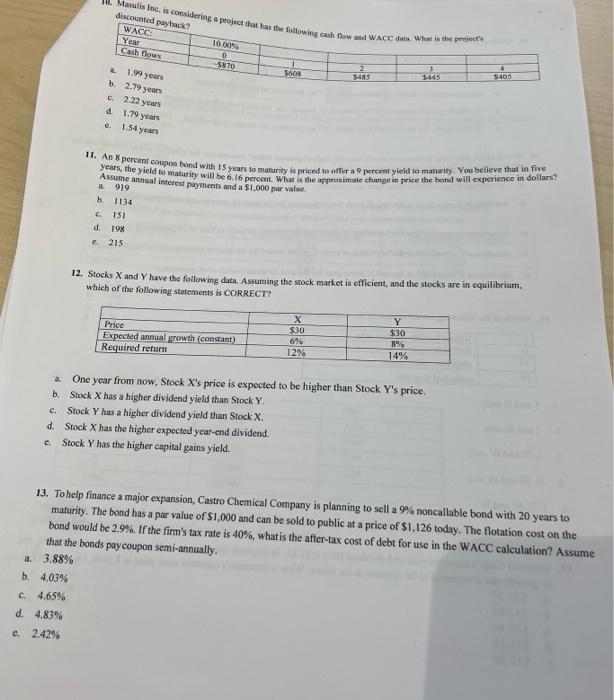

Question: post letter answer only Mawlis Inc. is considering a project that has the followin Gash flow and WACC dute. What is the project's discounted payback?

Mawlis Inc. is considering a project that has the followin Gash flow and WACC dute. What is the project's discounted payback? WACC: Year 10.00% Cash flows 0 -5870 2 S08 5485 sus 4 $40 1.99 years b.2.79 years 2.22 years 1.79 years 1.54 years d 11. An percent coupons bond with 15 years to maturity is priced to offer a percent yield to maturity. You believe that in five years, the yield to maturity will be 6.16 percent. What is the approximate change in price the band will experience in dollars? Assume annual interest payments and a $1.000 per value 919 b. 1134 c. 151 d 198 c. 215 12. Stocks X and Y have the following data. Assuming the stock market is efficient, and the stocks are in equilibrium, which of the following statements is CORRECT? Price Expected annual growth (constant) Required return X $30 6% 12% Y $30 89 14% a. One year from now. Stock X's price is expected to be higher than Stock Y's price. b. Stock X has a higher dividend yield than Stock Y c. Stock Y has a higher dividend yield than Stock X. d. Stock X has the higher expected year-end dividend. Stock Y has the higher capital gains yield. c. 13. To help finance a major expansion, Castro Chemical Company is planning to sell a 9% noncallable bond with 20 years to maturity. The bond has a par value of $1,000 and can be sold to public at a price of S1.126 today. The flotation cost on the bond would be 2.9%. If the firm's tax rate is 40%, what is the after-tax cost of debt for use in the WACC calculation? Assume that the bonds pay coupon semi-annually. a. 3.88% b. 4.03% c. 4.65% d. 4.83% c. 2.42%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts