Question: posted this before but answer was wrong, please give right answer Sheridan-tine the. (Stn) is a manufacturer that produces parts for residential telephones. Recent indications

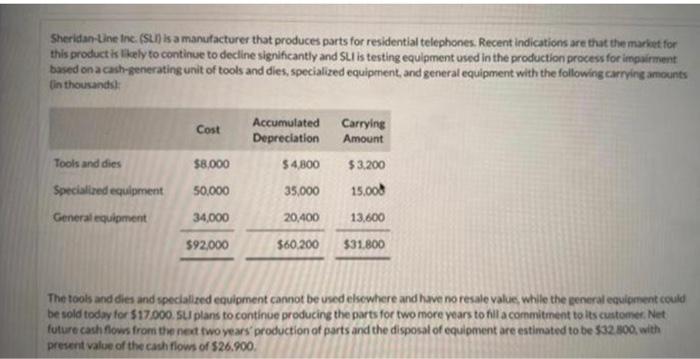

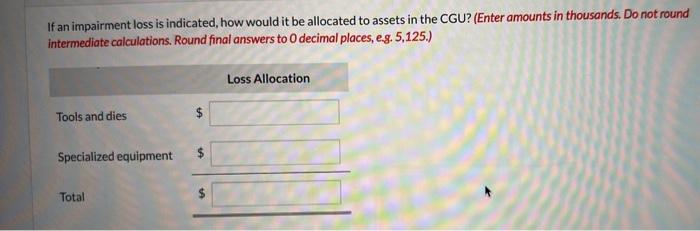

Sheridan-tine the. (Stn) is a manufacturer that produces parts for residential telephones. Recent indications are that the market for this product is Ikely to continue to decline significantly and SU is testing equipment used in the production process for inguirment based on a cash-henerating unit of tools and dies, specialized equipment, and general equipment with the following carrving amounts (in thousand: The tools and dies and specialized equipment cannot be used eliewhere and have no resale value, while the general equipment could be sold today for $17,000. StI plans to continue producing the parts for two more years to fili a commitment to its customer. Net future cash fows from the neat fwo years' production of parts and the disposal of equipment are estimated to be $32 a.00, with present value of the cash fiows of $26,900. If an impairment loss is indicated, how would it be allocated to assets in the CGU? (Enter amounts in thousands. Do not round intermediate calculations. Round final answers to 0 decimal places, e.g. 5,125.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts