Question: posted this question 2 times already and kept getting it wrong can someone please tell me the correct answers and double check their work. -

posted this question 2 times already and kept getting it wrong can someone please tell me the correct answers and double check their work.

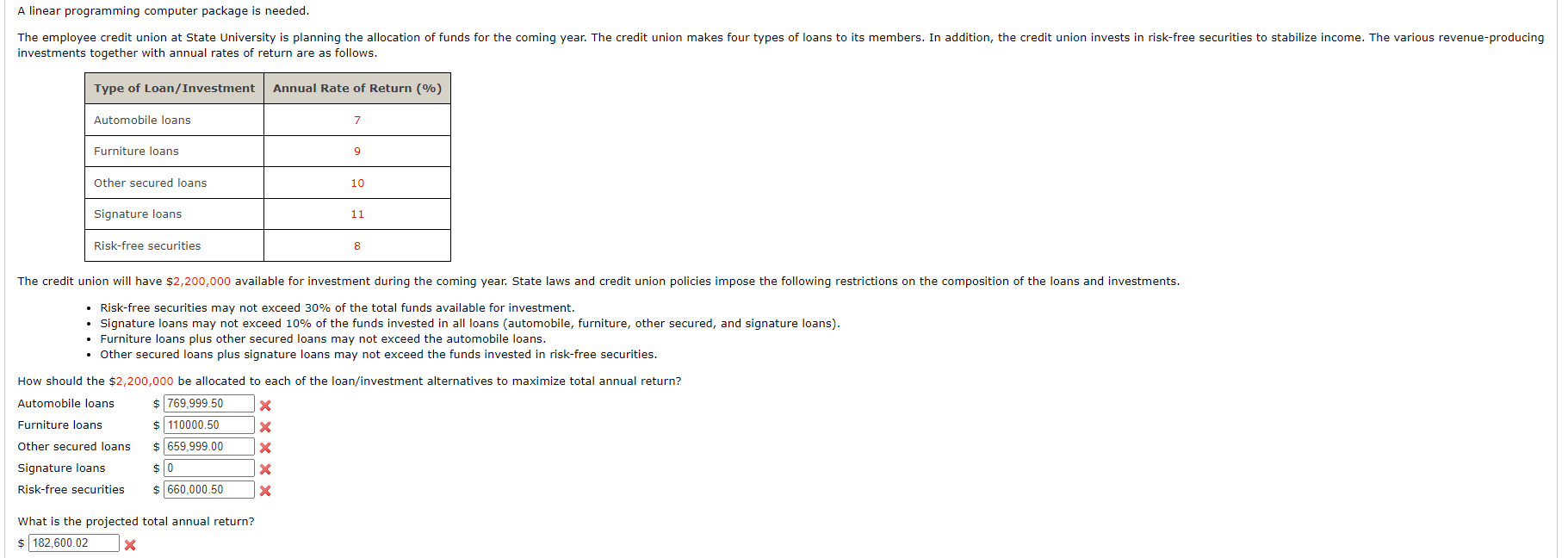

- Risk-free securities may not exceed 30% of the total funds available for investment. - Signature loans may not exceed 10% of the funds invested in all loans (automobile, furniture, other secured, and signature loans). - Furniture loans plus other secured loans may not exceed the automobile loans. - Other secured loans plus signature loans may not exceed the funds invested in risk-free securities. How should the $2,200,000 be allocated to each of the loan/investment alternatives to maximize total annual return? What is the projected total annual return? - Risk-free securities may not exceed 30% of the total funds available for investment. - Signature loans may not exceed 10% of the funds invested in all loans (automobile, furniture, other secured, and signature loans). - Furniture loans plus other secured loans may not exceed the automobile loans. - Other secured loans plus signature loans may not exceed the funds invested in risk-free securities. How should the $2,200,000 be allocated to each of the loan/investment alternatives to maximize total annual return? What is the projected total annual return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts