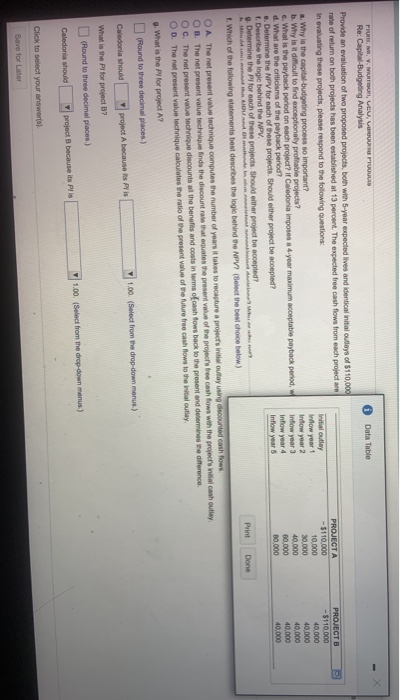

Question: POUR PROTI Y. , LEUR Re: Capital-Budgeng Analysis 6 Data Table PROJECT A PROJECT -$110,000 Initial outlay now year 1 Inow year 2 40,000 40,000

POUR PROTI Y. , LEUR Re: Capital-Budgeng Analysis 6 Data Table PROJECT A PROJECT -$110,000 Initial outlay now year 1 Inow year 2 40,000 40,000 Provide an evaluation of two proposed projects, both with 5-year expected lives and Identical initial outays of $110,000 rate of return on both projects has been established at 13 percent. The expected free cash flows from each project are In evaluating these projects, please respond to the following questions: a. Why is the capital-budgeting process so important? b. Why is it difficult to find exceptionally profnable projects? c. What is the payback period on each project? If Caledonia imposes a 4-year maximum acceptable payback period, d. What are the criticisms of the payback period? e. Determine the NPV for each of these projects. Should either project be accepted? 1. Describe the logic behind the NPV. Determine the Prfor each of these projects. Should either project be accepted? AIOVA man inte (Select the best choice below) 1. Which of the following statements best describes the logic behind the NPV Infow year 4 Inflow years Done capture a projects in oulay using discounted cash flows O A The not present value technique computes the number of years it takes to cash outley OB. The nel present value technique finds the discount rate that equates the present value of the projects free cash fows with the projects in difference OC. The not present value tochnique discounts at the benefits and costs in terms of cash fows back to the present and determine O D The nel present value technique calculates the ratio of the present value of the future free cash flows to the initial outlay g. What is the Pi for project A? (Round to three decimal places.) 1.00 Select from the drop-down menus.) Caledonia should project A because it is What is the Pl for project B? (Round to three decimal places.) Caledonia should project because its Pris 1.00 Select from the drop-down menus) Click to select your answers Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts