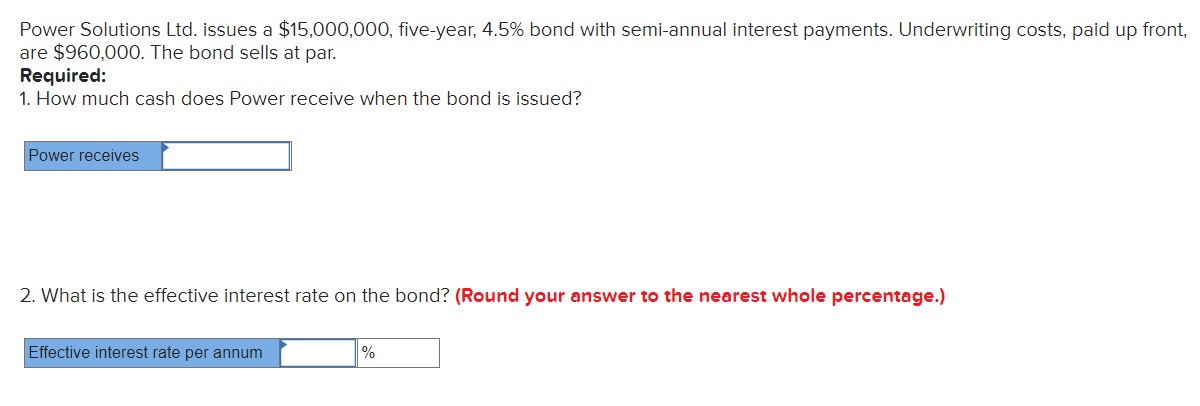

Question: Power Solutions Ltd. issues a $15,000,000, fiveyear. 4.5% bond with semiannual interest payments. Underwriting costs, paid up front, are $960,000. The bond sells at par.

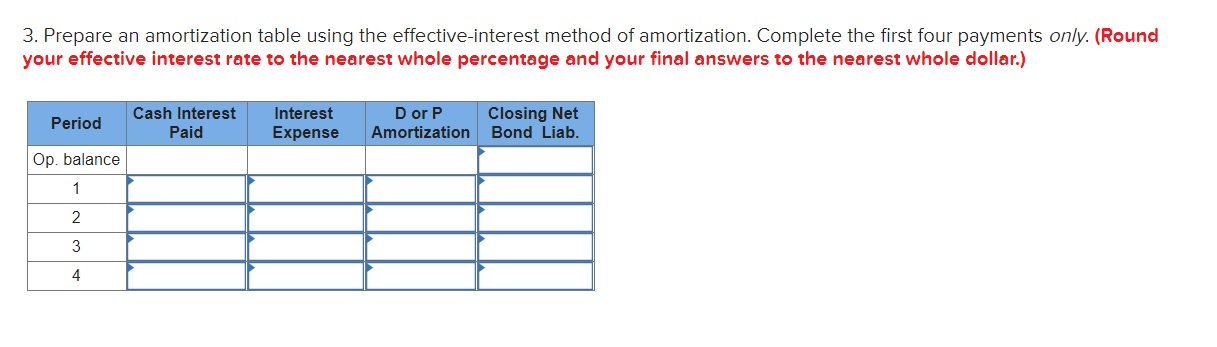

Power Solutions Ltd. issues a $15,000,000, fiveyear. 4.5% bond with semiannual interest payments. Underwriting costs, paid up front, are $960,000. The bond sells at par. Required: 1. How much cash does Power receive when the bond is issued? El 2. What is the effective interest rate on the bond? [Round your answer to the nearest whole percentage.) 3. Prepare an amortization table using the effective-interest method of amortization. Complete the first four payments only. (Round your effective interest rate to the nearest whole percentage and your final answers to the nearest whole dollar.) Period Cash Interest Interest D or P Closing Net Paid Expense Amortization Bond Liab. Op. balance 2 4

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we need to address each part separately 1 Cash Received When the Bond is Issued The bond sells at par meaning the bonds face val... View full answer

Get step-by-step solutions from verified subject matter experts