Question: PR 8 - 3 5 ( Algo ) Variable - Costing and Absorption - Costing Income Statements ( LO 8 - 2 , 8 -

PR Algo VariableCosting and AbsorptionCosting Income Statements LO Required:

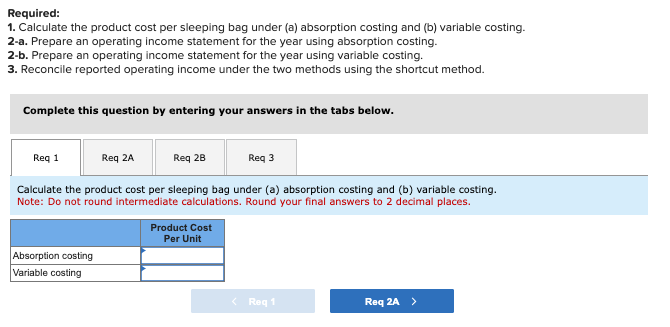

Calculate the product cost per sleeping bag under a absorption costing and b variable costing.

a Prepare an operating income statement for the year using absorption costing.

b Prepare an operating income statement for the year using variable costing.

Reconcile reported operating income under the two methods using the shortcut method.

Complete this question by entering your answers in the tabs below.

Req

Req

Prepare an operating income statement for the year using absorption costing.

Note: Do not round intermediate calculations. Required:

Calculate the product cost per sleeping bag under a absorption costing and b variable costing.

a Prepare an operating income statement for the year using absorption costing.

b Prepare an operating income statement for the year using variable costing.

Reconcile reported operating income under the two methods using the shortcut method.

Complete this question by entering your answers in the tabs below.

Req

Prepare an operating income statement for the year using variable costing.

Note: Do not round intermediate calculations. Required:

Calculate the product cost per sleeping bag under a absorption costing and b variable costing.

a Prepare an operating income statement for the year using absorption costing.

b Prepare an operating income statement for the year using variable costing.

Reconcile reported operating income under the two methods using the shortcut method.

Complete this question by entering your answers in the tabs below.

Req A

Reconcile reported operating income under the two methods using the shortcut method.

Note: Round your predetermined fixed overhead rate to decimal places.

Great Outdoze Company manufactures sleeping bags, which sell for $ each. The variable costs of production are as follows:

Direct material $

Direct labor

Variable manufacturing overhead

Budgeted fixed overhead in x was $ and budgeted production was sleeping bags. The years actual production was units, of which were sold. Variable selling and administrative costs were $ per unit sold; fixed selling and administrative costs were $

Required:

Calculate the product cost per sleeping bag under a absorption costing and b variable costing.

a Prepare an operating income statement for the year using absorption costing.

b Prepare an operating income statement for the year using variable costing.

Reconcile reported operating income under the two methods using the shortcut method.Required:

Calculate the product cost per sleeping bag under a absorption costing and b variable costing.

a Prepare an operating income statement for the year using absorption costing.

b Prepare an operating income statement for the year using variable costing.

Reconcile reported operating income under the two methods using the shortcut method.

Complete this question by entering your answers in the tabs below.

Req B

Req

Calculate the product cost per sleeping bag under a absorption costing and b variable costing.

Note: Do not round intermediate calculations. Round your final answers to decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock