Question: PRACTICE 1 - Decision Making Under Uncertainty and Risk: A stock market advisory service offers three investments portictios for one of its customers. All portfolios

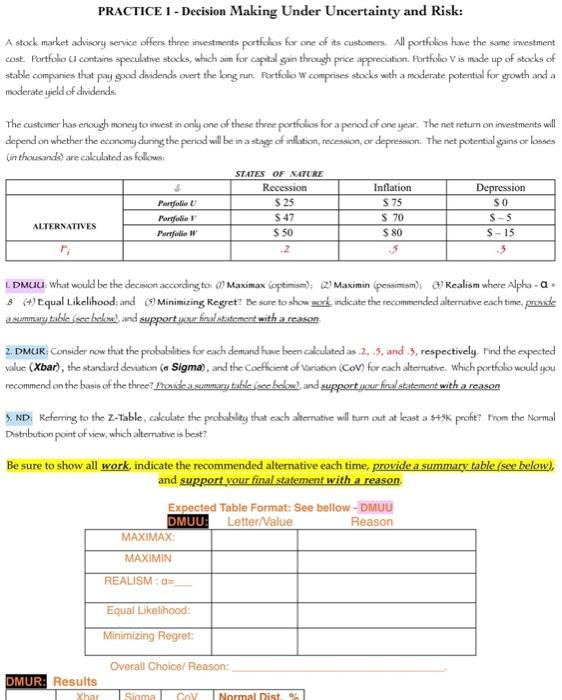

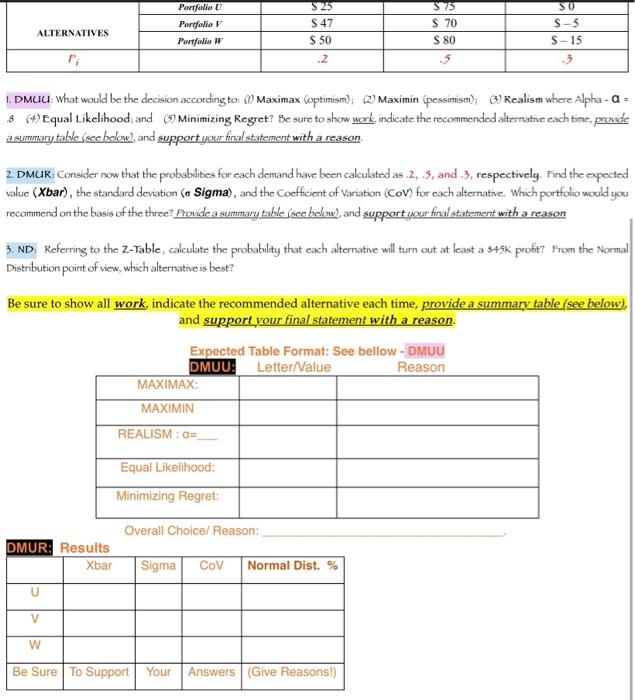

PRACTICE 1 - Decision Making Under Uncertainty and Risk: A stock market advisory service offers three investments portictios for one of its customers. All portfolios have the same imestment cost. Portfolio 4 contains speculative stocks, which aim for capital gain through price appreciation. Fortfolio V is made up of stocks of statbie comparies that poy good dividends overt the lang run. Portfolio w comprises stocks with a moderate potential for growth and a moderate yield of dividends. The customer has enough money to imest in only one of these three portfolias for a penod of one ayear. The net retum on imestments will depend on whether the economy during the period will be in a stagz of inflition, recession, or depression. The net potential gains or losses (in thousande) are cilculated as follows: L. DMuC: What would be the docision according toi (0 Maximax (optimism); [2] Maximin (pessimism); (3) Realism where Alpha - a a s (4) Equal Likelihood; and (5) Minimizing Regret? Be sume to show ank, indicate the recommended alternative each time, proske asummary aible isee brelowi, and support ikzer find stidemert with a reasong. 2. DMUR: Consider now that the probabities for each demand hane been calculated as ,2,5, and .3, respectively. Find the expected value (Xbar), the standand devation ( Sigma), and the Coeffient of Variation (CoV) for each atternative. which portfolio would you recommend on the busis of the three? Phovile senmmamy table isee belowl. and support inaur final atatement with a reason 3. NDi Referning to the Z-Table, calcalate the probablity that exch altemative will turn out at least a s45K profit? Trom the Normal Distribution point of view, which alternative is best? Be sure to show all work, indicate the recommended alternative each time, provide a summary table (see below), and support your final statement with a reason. Overall Choicel Reason: 1. DMUCl: What would be the decision according to: ( Maximax (optimism); (2) Maximin (pessimism); (3) Realism where Alpha - Q= s (4) Equal Likelihood; and (5) Minimizing Regret? Be sure to show work, indicate the recommended alternative each time, provide a summary table (see below), and support your finalstatement with a reason. 2. DMCIR. Consider now that the probablities for each demand have been calculated as .2,.5, and . 3 , respectively. Find the expected value (Xbar), the standard deviation ( Sigma), and the Coefficient of variation (CoV) for each alternative. Which portfolio would you recommend on the basis of the three? Frovide a summary table (see below), and support ugur final statement with a reason 3. ND: Referring to the Z-Table, calculate the probability that each altemative will turn out at least a s45K profit? From the Normal Distribution point of view, which alternative is best? Be sure to show all work, indicate the recommended alternative each time, provide a summary table (see below), and support your final statement with a reason. Overall Choice/ Reason

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts