Question: Practice 1 (Straight -line Method ) Supersonic Company was authorized to issue 12 % 10-year bond with face amount of P 7,000,000 on January 1,

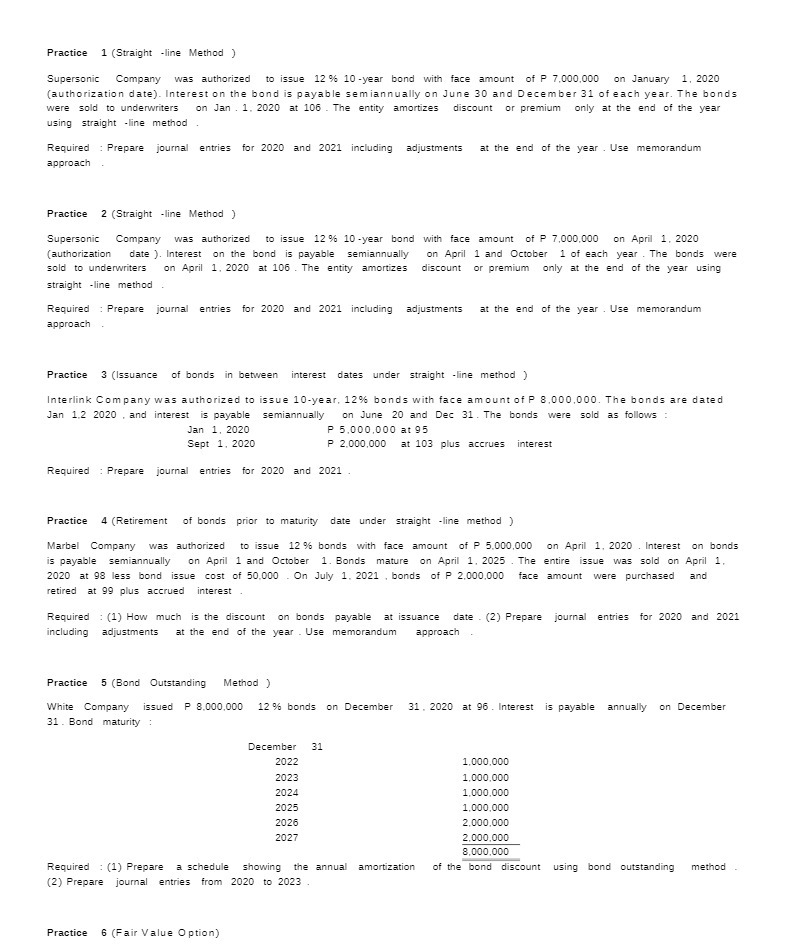

Practice 1 (Straight -line Method ) Supersonic Company was authorized to issue 12 % 10-year bond with face amount of P 7,000,000 on January 1, 2020 (authorization date). Interest on the bond is payable semiannually on June 30 and December 31 of each year. The bonds were sold to underwriters on Jan . 1. 2020 at 106 . The entity amortizes discount or premium only at the end of the year using straight -line method Required : Prepare journal entries for 2020 and 2021 including adjustments at the end of the year . Use memorandum approach Practice 2 (Straight -line Method ) Supersonic Company was authorized to issue 12 % 10 -year bond with face amount of P 7,000,000 on April 1, 2020 (authorization date ). Interest on the bond is payable semiannually on April 1 and October 1 of each year . The bonds were sold to underwriters on April 1, 2020 at 106 . The entity amortizes discount or premium only at the end of the year using straight -line method Required : Prepare journal entries for 2020 and 2021 including adjustments at the end of the year . Use memorandum approach Practice 3 (Issuance of bonds in between interest dates under straight -line method ) Interlink Company was authorized to issue 10-year, 12% bonds with face amount of P 8,000,000. The bonds are dated Jan 12 2020 , and interest is payable semiannually on June 20 and Dec 31. The bonds were sold as follows : Jan 1, 2020 P 5.000,000 at 95 Sept 1, 2020 P 2.000,000 at 103 plus accrues interest Required : Prepare journal entries for 2020 and 2021 Practice 4 (Retirement of bonds prior to maturity date under straight -line method ) Marbel Company was authorized to issue 12 % bonds with face amount of P 5,000,000 on April 1, 2020 . Interest on bonds is payable semiannually on April 1 and October 1. Bonds mature on April 1. 2025 . The entire issue was sold on April 1, 2020 at 98 less bond issue cost of 50,000 . On July 1. 2021 , bonds of P 2,000.000 face amount were purchased and retired at 99 plus accrued interest Required : (1) How much is the discount on bonds payable at issuance date . (2) Prepare journal entries for 2020 and 2021 including adjustments at the end of the year . Use memorandum approach Practice 5 (Bond Outstanding Method ) White Company issued P 8.000,000 12 % bonds on December 31. 2020 at 96 . Interest is payable annually on December 31 . Bond maturity : December 31 2022 1,000,000 2023 1,000,000 2024 1,000.000 2025 1,000,000 2026 2.000,000 2027 2.000,000 8,000,000 Required : (1) Prepare a schedule showing the annual amortization of the bond discount using bond outstanding method (2) Prepare journal entries from 2020 to 2023 Practice 6 (Fair Value Option)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts