Question: Practice 8.1 Constant Dividend Growth Model Suppose we have a stock with the following information: Dividend Next year: $5.00 Dividend growth rate: 6.00% Required return:

Practice 8.1 Constant Dividend Growth Model

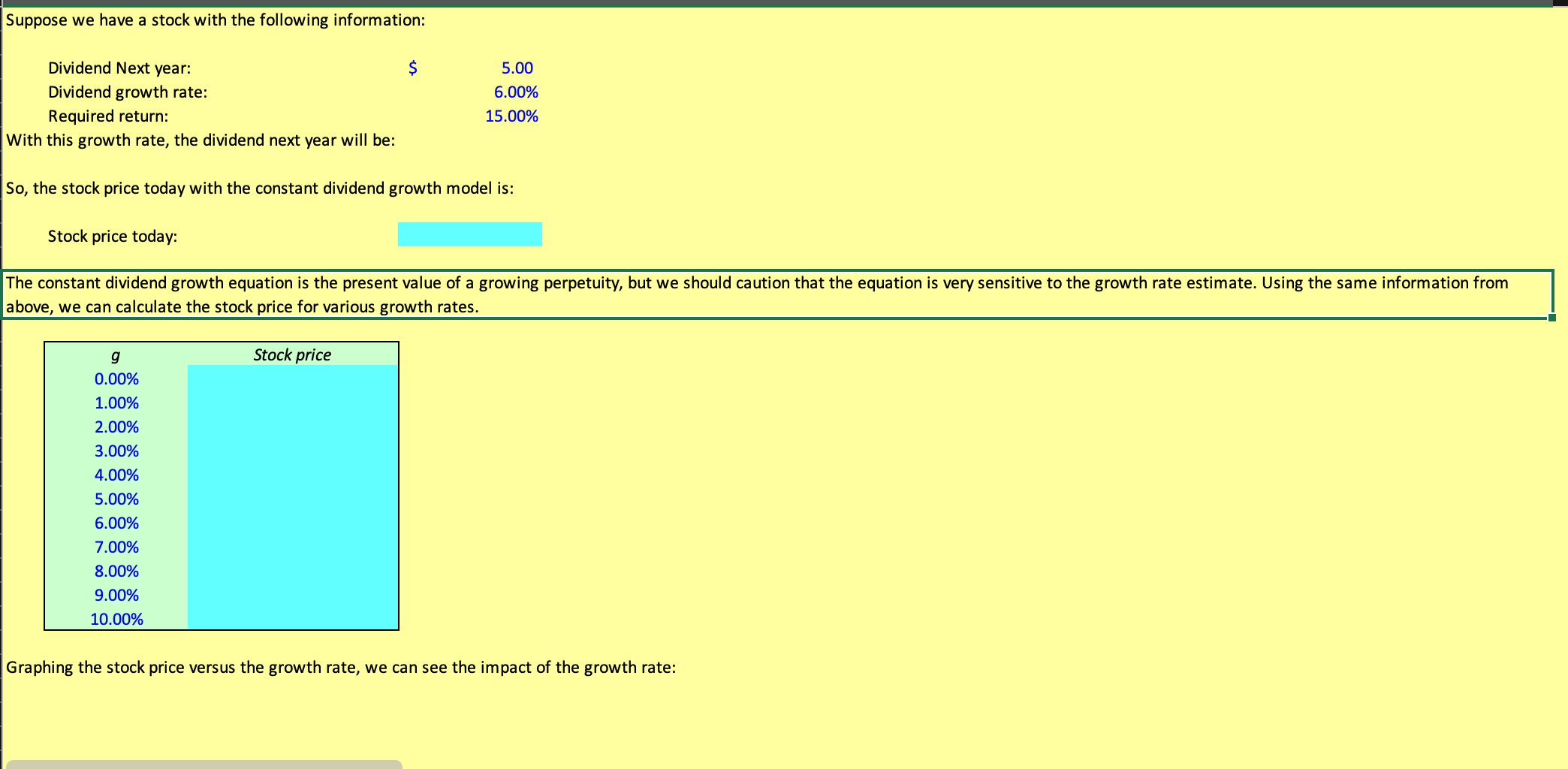

Suppose we have a stock with the following information: Dividend Next year: $5.00 Dividend growth rate: 6.00% Required return: 15.00% With this growth rate, the dividend next year will be: So, the stock price today with the constant dividend growth model is:

Stock price today: The constant dividend growth equation is the present value of a growing perpetuity, but we should caution that the equation is very sensitive to the growth rate estimate.

Using the same information from above, we can calculate the stock price for various growth rates.

Suppose we have a stock with the following information: $ Dividend Next year: Dividend growth rate: Required return: With this growth rate, the dividend next year will be: 5.00 6.00% 15.00% So, the stock price today with the constant dividend growth model is: Stock price today: The constant dividend growth equation is the present value of a growing perpetuity, but we should caution that the equation is very sensitive to the growth rate estimate. Using the same information from above, we can calculate the stock price for various growth rates. Stock price g 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% Graphing the stock price versus the growth rate, we can see the impact of the growth rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts