Question: Practice Assignment #8 Question 16 (1 point) MICH Corporation has its common stock selling for $50/share and the expected dividend one year from today (D1)

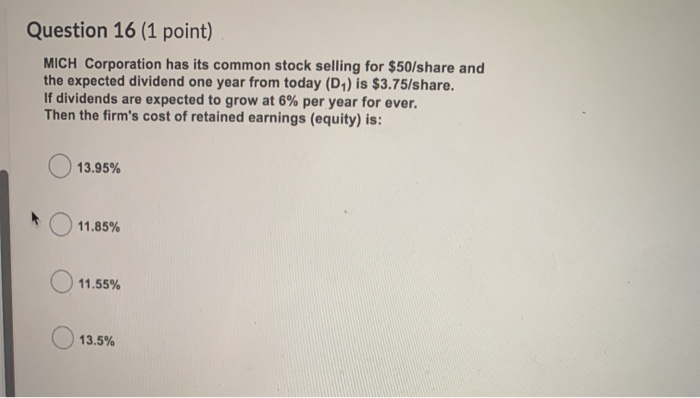

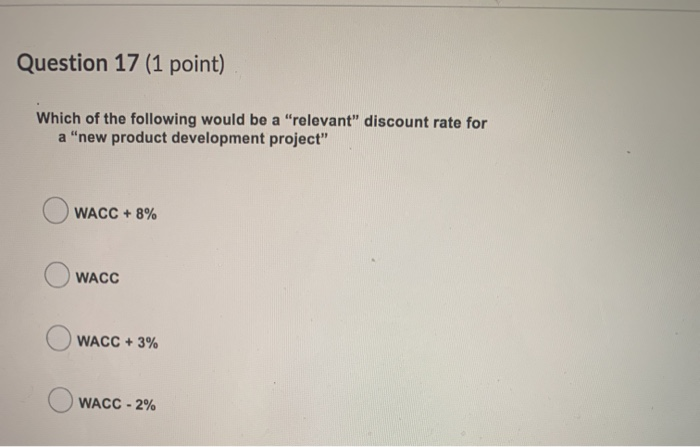

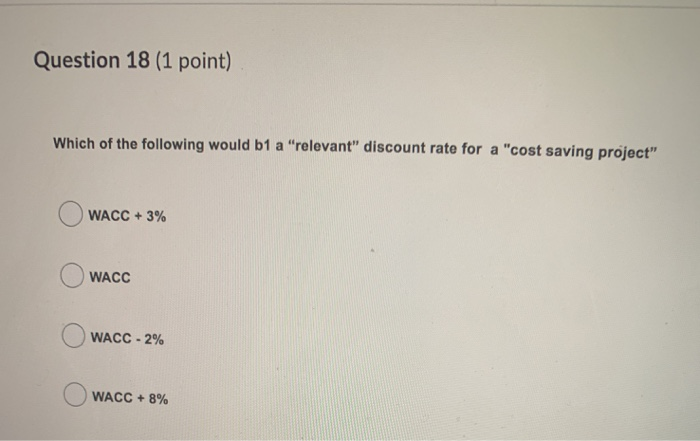

Question 16 (1 point) MICH Corporation has its common stock selling for $50/share and the expected dividend one year from today (D1) is $3.75/share. If dividends are expected to grow at 6% per year for ever. Then the firm's cost of retained earnings (equity) is: 13.95% 11.85% 11.55% 13.5% Question 17 (1 point) Which of the following would be a "relevant" discount rate for a "new product development project" OWACC + 8% O wacc WACC + 3% OWACC - 2% Question 18 (1 point) Which of the following would b1 a "relevant" discount rate for a "cost saving project" WACC + 3% OWACC OWACC - 2% WACC + 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts