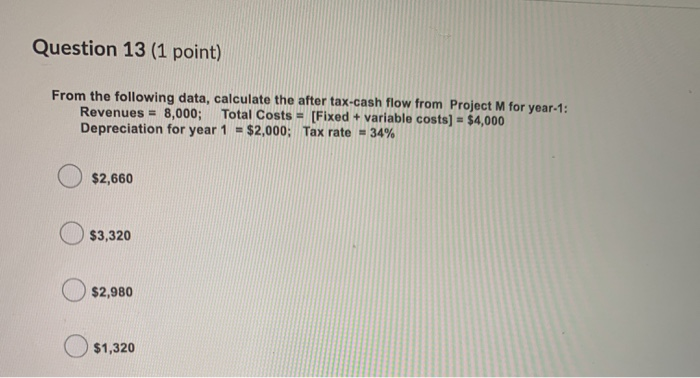

Question: Practice Assignment #8 Question 13 (1 point) From the following data, calculate the after tax-cash flow from Project M for year-1: Revenues = 8,000; Total

Practice Assignment #8

![8,000; Total Costs = [Fixed + variable costs] = $4,000 Depreciation for](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe959011f01_46366fe958f7702e.jpg)

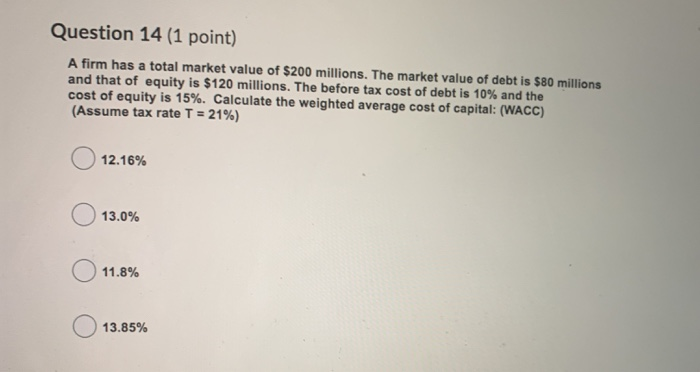

Question 13 (1 point) From the following data, calculate the after tax-cash flow from Project M for year-1: Revenues = 8,000; Total Costs = [Fixed + variable costs] = $4,000 Depreciation for year 1 = $2,000; Tax rate - 34% $2,660 $3,320 $2,980 $1,320 Question 14 (1 point) A firm has a total market value of $200 millions. The market value of debt is $80 millions and that of equity is $120 millions. The before tax cost of debt is 10% and the cost of equity is 15%. Calculate the weighted average cost of capital: (WACC) (Assume tax rate T = 21%) 12.16% 13.0% 11.8% 13.85% Question 15 (1 point) KALM Corporation has its common stock selling for $55/share and the current dividend (D) is $2.50/share. If dividends are expected to grow at 7% per year for ever; then the firm's cost of retained earnings (equity) is: 11.86% 10.45% 12.22% 11.55%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts