Question: Practice Exercise #2 Magic Resort and Casino opened for business on January 1, 2022 Adjusting entries: The mortgage interest rate is 9% per year. The

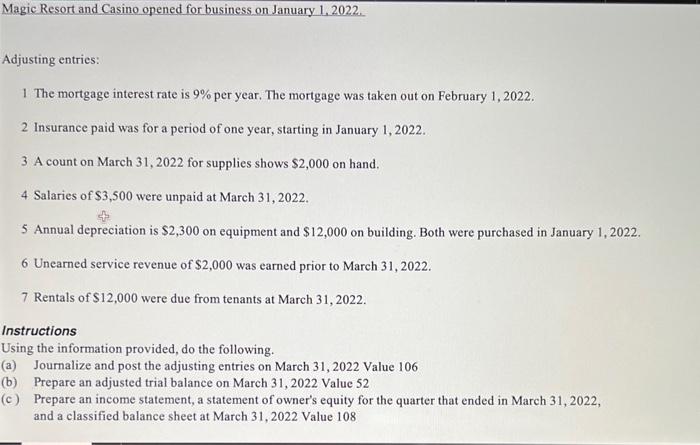

Magic Resort and Casino opened for business on January 1, 2022

Adjusting entries:

The mortgage interest rate is 9% per year. The mortgage was taken out on February 1, 2022

2 Insurance paid was for a period of one year. starting in January 1. 2022

3 A count on March 31, 2022 for supplies shows $2,000 on hand.

- Salaries of $3,500 were unpaid at March 31, 2022.

- Annual depreciation is $2,300 on equipment and $12,000 on building. Both were purchased in January 1, 2022

- Unearned service revenue of $2,000 was earned prior to March 31, 2022.

- Rentals of $12,000 were due from tenants at March 31, 2022.

Instructions

Using the information provided, do the following.

(a) Journalize and post the adjusting entries on March 31, 2022 Value 106 (b) Prepare an adjusted trial balance on March 31, 2022 Value 52

(c)

Prepare an income statement, a statement of owner's equity for the quarter that ended in March 31, 2022

and a classified balance sheet at March 31, 2022 Value 108

Adjusting entries: 1 The mortgage interest rate is 9% per year. The mortgage was taken out on February 1, 2022. 2 Insurance paid was for a period of one year, starting in January 1,2022. 3 A count on March 31, 2022 for supplies shows $2,000 on hand. 4 Salaries of $3,500 were unpaid at March 31, 2022. 5 Annual depreciation is $2,300 on equipment and $12,000 on building. Both were purchased in January 1,2022. 6 Unearned service revenue of $2,000 was earned prior to March 31,2022. 7 Rentals of $12,000 were due from tenants at March 31, 2022. Instructions Using the information provided, do the following. (a) Journalize and post the adjusting entries on March 31, 2022 Value 106 (b) Prepare an adjusted trial balance on March 31, 2022 Value 52 (c) Prepare an income statement, a statement of owner's equity for the quarter that ended in March 31, 2022, and a classified balance sheet at March 31,2022 Value 108 Adjusting entries: 1 The mortgage interest rate is 9% per year. The mortgage was taken out on February 1, 2022. 2 Insurance paid was for a period of one year, starting in January 1,2022. 3 A count on March 31, 2022 for supplies shows $2,000 on hand. 4 Salaries of $3,500 were unpaid at March 31, 2022. 5 Annual depreciation is $2,300 on equipment and $12,000 on building. Both were purchased in January 1,2022. 6 Unearned service revenue of $2,000 was earned prior to March 31,2022. 7 Rentals of $12,000 were due from tenants at March 31, 2022. Instructions Using the information provided, do the following. (a) Journalize and post the adjusting entries on March 31, 2022 Value 106 (b) Prepare an adjusted trial balance on March 31, 2022 Value 52 (c) Prepare an income statement, a statement of owner's equity for the quarter that ended in March 31, 2022, and a classified balance sheet at March 31,2022 Value 108

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts