Question: *Practice Exercise 4-5 The following information is available for Larkspur Inc. for the year ended December 31, 2017 Loss on discontinued operations Rent revenue Income

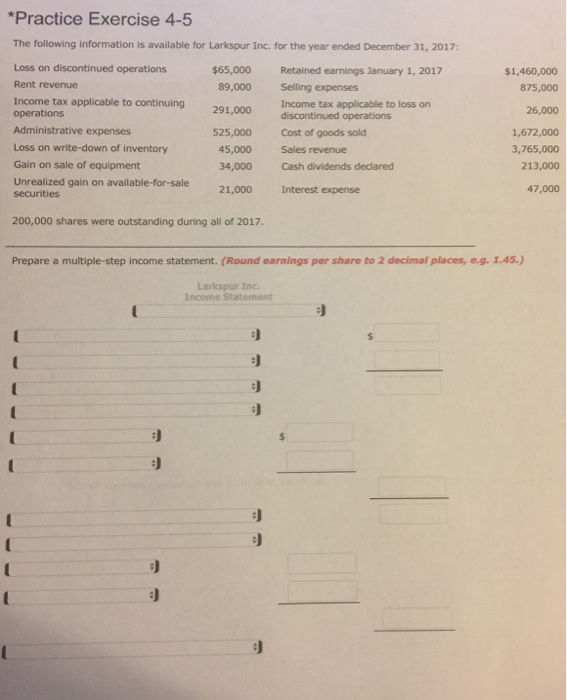

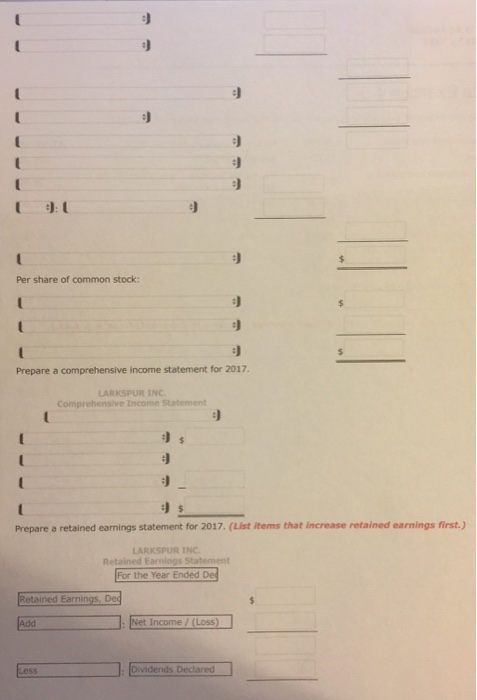

*Practice Exercise 4-5 The following information is available for Larkspur Inc. for the year ended December 31, 2017 Loss on discontinued operations Rent revenue Income tax applicable to continuing operations Administrative expenses Loss on write-down of inventory Gain on sale of equipment Unrealized gain on available-for-sale $65,000 $1,460,000 875,000 26,000 1,672,000 3,765,000 213,000 47,000 Retained earnings January 1, 2017 89,000 Selling expenses 291,000 discontinued operations 525,000Cost of goods sold Income tax applicable to loss on 45,000 Sales revenue 34,000 Cash dividends dedlared 21,000 Interest expense securities 200,000 shares were outstanding during all of 2017. Prepare a multiple-step income statement. (Round earnings per share to 2 decimal places, e.g. 1.45.) Larkspur Inc. Income Statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts