Question: Practice Operating Assumptions for Revenue projections 1. Assume work is for not for profit health system 2. Assume physicians see patients 5 days/week 3. Assume

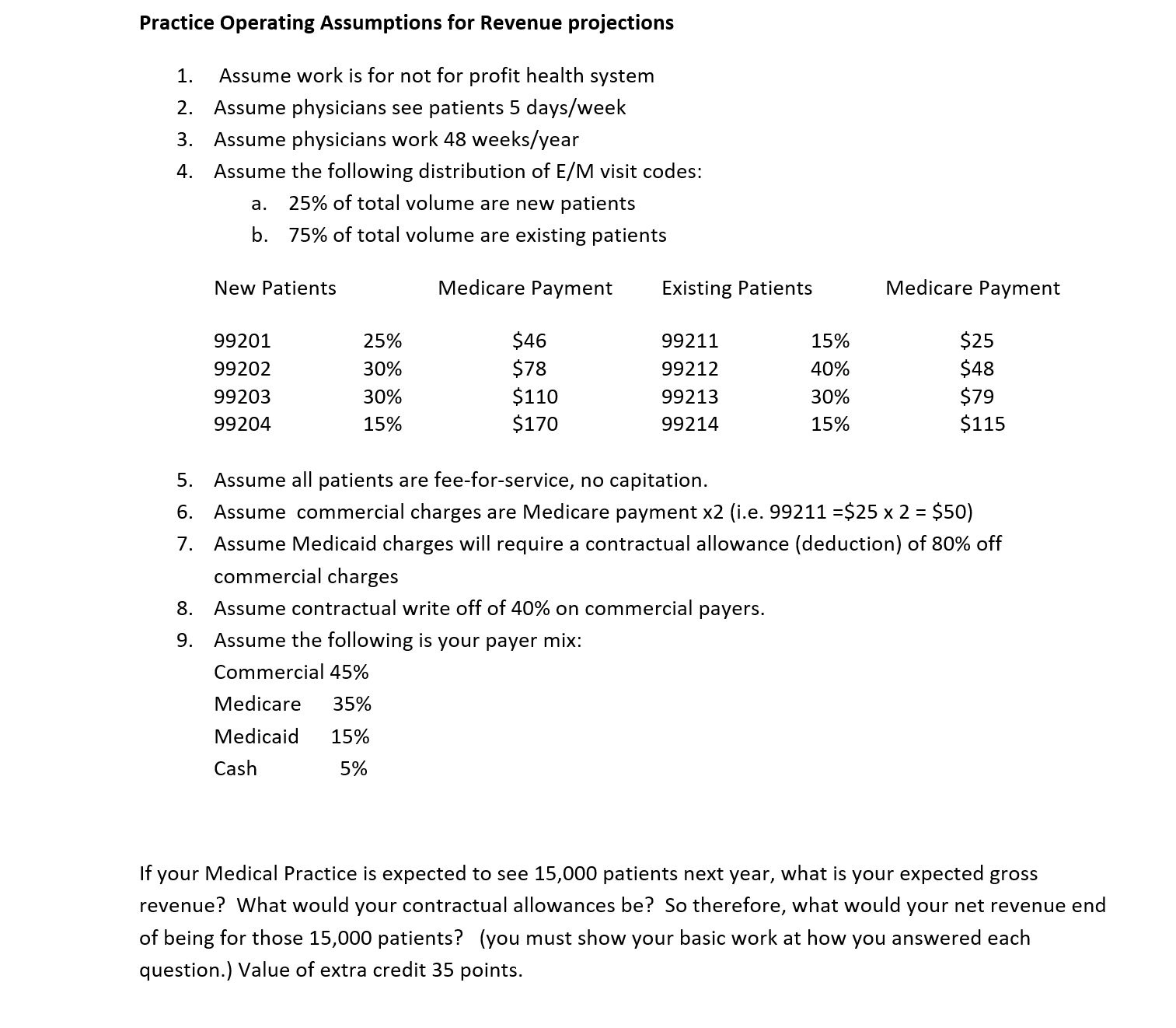

Practice Operating Assumptions for Revenue projections 1. Assume work is for not for profit health system 2. Assume physicians see patients 5 days/week 3. Assume physicians work 48 weeks/year 4. Assume the following distribution of E/M visit codes: 25% of total volume are new patients b. 75% of total volume are existing patients a. New Patients Medicare Payment Existing Patients Medicare Payment 99211 99212 99201 99202 99203 99204 25% 30% 30% 15% $46 $78 $110 $170 15% 40% 30% 15% $25 $48 $79 $115 99213 99214 5. Assume all patients are fee-for-service, no capitation. 6. Assume commercial charges are Medicare payment x2 (i.e. 99211 =$25 x 2 = $50) 7. Assume Medicaid charges will require a contractual allowance (deduction) of 80% off commercial charges 8. Assume contractual write off of 40% on commercial payers. 9. Assume the following is your payer mix: Commercial 45% Medicare 35% Medicaid 15% Cash 5% If your Medical Practice is expected to see 15,000 patients next year, what is your expected gross revenue? What would your contractual allowances be? So therefore, what would your net revenue end of being for those 15,000 patients? (you must show your basic work at how you answered each question.) Value of extra credit 35 points. Practice Operating Assumptions for Revenue projections 1. Assume work is for not for profit health system 2. Assume physicians see patients 5 days/week 3. Assume physicians work 48 weeks/year 4. Assume the following distribution of E/M visit codes: 25% of total volume are new patients b. 75% of total volume are existing patients a. New Patients Medicare Payment Existing Patients Medicare Payment 99211 99212 99201 99202 99203 99204 25% 30% 30% 15% $46 $78 $110 $170 15% 40% 30% 15% $25 $48 $79 $115 99213 99214 5. Assume all patients are fee-for-service, no capitation. 6. Assume commercial charges are Medicare payment x2 (i.e. 99211 =$25 x 2 = $50) 7. Assume Medicaid charges will require a contractual allowance (deduction) of 80% off commercial charges 8. Assume contractual write off of 40% on commercial payers. 9. Assume the following is your payer mix: Commercial 45% Medicare 35% Medicaid 15% Cash 5% If your Medical Practice is expected to see 15,000 patients next year, what is your expected gross revenue? What would your contractual allowances be? So therefore, what would your net revenue end of being for those 15,000 patients? (you must show your basic work at how you answered each question.) Value of extra credit 35 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts