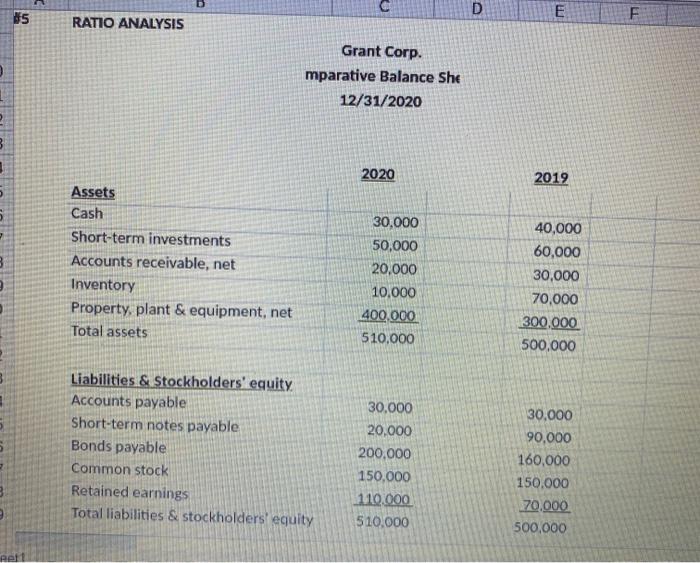

Question: Practice Problem D E 85 F RATIO ANALYSIS Grant Corp. mparative Balance She 12/31/2020 3 2020 2019 Assets Cash Short-term investments Accounts receivable, net Inventory

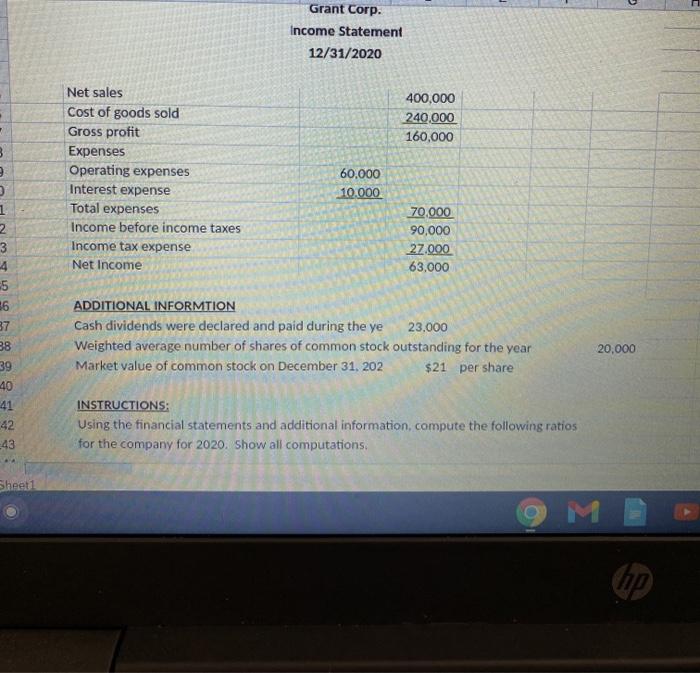

D E 85 F RATIO ANALYSIS Grant Corp. mparative Balance She 12/31/2020 3 2020 2019 Assets Cash Short-term investments Accounts receivable, net Inventory Property, plant & equipment, net Total assets 30,000 50,000 20,000 10,000 400 000 510,000 40,000 60,000 30,000 70,000 300,000 500,000 Liabilities & Stockholders' equity Accounts payable Short-term notes payable Bonds payable Common stock Retained earnings Total liabilities & stockholders' equity 30,000 20.000 200,000 150,000 110.000 510.000 30,000 90,000 160,000 150.000 170.000 500,000 Ref Grant Corp. Income Statement 12/31/2020 400,000 240.000 160,000 B e Net sales Cost of goods sold Gross profit Expenses Operating expenses Interest expense Total expenses Income before income taxes Income tax expense Net Income 60,000 10.000 1 2 3 70.000 90,000 27.000 63,000 5 56 37 38 39 40 41 42 -43 ADDITIONAL INFORMTION Cash dividends were declared and paid during the ye 23.000 Weighted average number of shares of common stock outstanding for the year Market value of common stock on December 31, 202 $21 per share 20,000 INSTRUCTIONS: Using the financial statements and additional information, compute the following ratios for the company for 2020. Show all computations Sheet You can use the formulas provided to do the ratio problem 1 CURRENT RATO 5 6 -7 8 19 50 51 62 53 54 55 56 157 158 159 160 161 162 163 164 165 166 2 RETURN ON COMMON STOCKHOLDERS' EQUITY Sheet1 You can use the formulas provided to do the ratio problem 1 CURRENT RATO 5 6 -7 8 19 50 51 62 53 54 55 56 157 158 159 160 161 162 163 164 165 166 2 RETURN ON COMMON STOCKHOLDERS' EQUITY Sheet1 A 3 B PRICE EARNINGS RATIO D E F G 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 ACID TEST RATIO 5 ACCOUNTS RECEIVABLES TURNOVER Sheet1 ME Calibri 11 B IU A f A B C D E 6 TIMES INTEREST EARNED 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 7 PROFIT MARGIN 8 DAYS IN INVENTORY 235 Sheet Calibri 11 BIUA * A B D E 9 PAYOUT RATIO 236 237 238 239 240 241 242 243 244 245 246 247 248 249 250 251 252 253 254 255 256 10 RETURN ON ASSETS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts