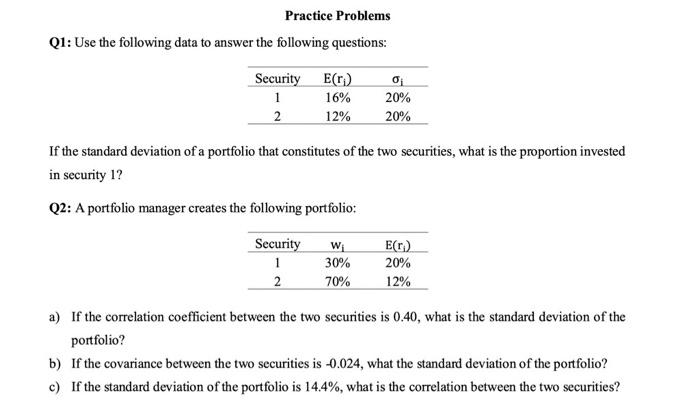

Question: Practice Problems Q1: Use the following data to answer the following questions: Security 1 2 EO) 16% 12% 01 20% 20% If the standard deviation

Practice Problems Q1: Use the following data to answer the following questions: Security 1 2 EO) 16% 12% 01 20% 20% If the standard deviation of a portfolio that constitutes of the two securities, what is the proportion invested in security 12 Q2: A portfolio manager creates the following portfolio: Security 1 2 w 30% 70% Er) 20% 12% a) If the correlation coefficient between the two securities is 0.40, what is the standard deviation of the portfolio? b) If the covariance between the two securities is 0.024, what the standard deviation of the portfolio? c) If the standard deviation of the portfolio is 14.4%, what is the correlation between the two securities? Practice Problems Q1: Use the following data to answer the following questions: Security 1 2 EO) 16% 12% 01 20% 20% If the standard deviation of a portfolio that constitutes of the two securities, what is the proportion invested in security 12 Q2: A portfolio manager creates the following portfolio: Security 1 2 w 30% 70% Er) 20% 12% a) If the correlation coefficient between the two securities is 0.40, what is the standard deviation of the portfolio? b) If the covariance between the two securities is 0.024, what the standard deviation of the portfolio? c) If the standard deviation of the portfolio is 14.4%, what is the correlation between the two securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts