Question: practice question - please type in the answers - do not post pictures 1. Grohl Co. has bonds with 10 years to maturity that make

practice question - please type in the answers - do not post pictures

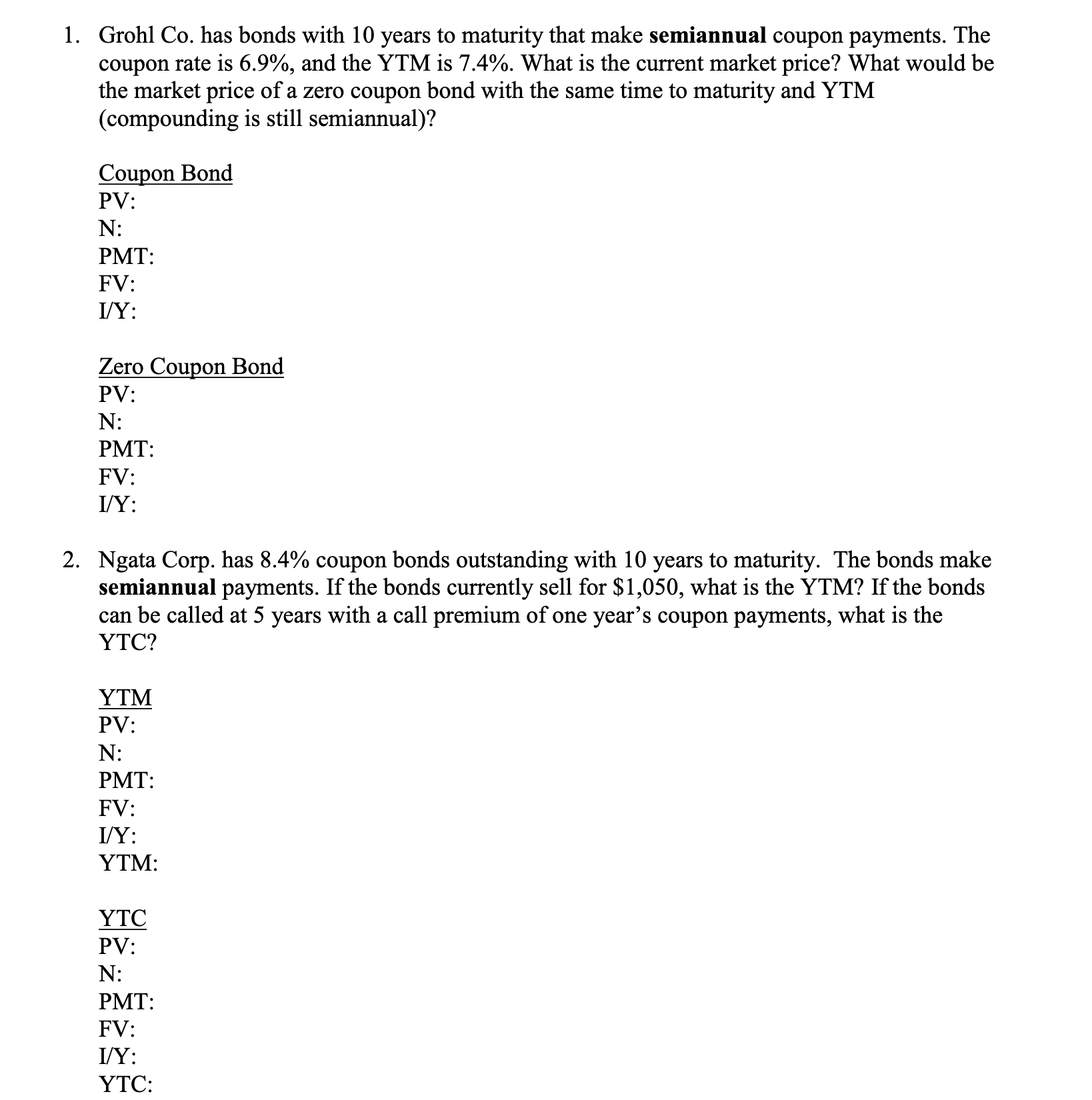

1. Grohl Co. has bonds with 10 years to maturity that make semiannual coupon payments. The coupon rate is 6.9%, and the YTM is 7.4%. What is the current market price? What would be the market price of a zero coupon bond with the same time to maturity and YTM compounding is still semiannual)? Coupon Bond PV N: PMT: FV I/Y: Zero Coupon Bond PV: N: PMT: FV I/Y: 2. Ngata Corp. has 8.4% coupon bonds outstanding with 10 years to maturity. The bonds make semiannual payments. If the bonds currently sell for $1,050, what is the YTM? If the bonds can be called at 5 years with a call premium of one year's coupon payments, what is the YTC? YTM PV: N: PMT: FV: V/Y: YTM: YTC PV: N: PMT: FV I/Y: YTC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts