Question: practice questions - please type in the answers - do not post pictures 3. Ashes Divide Corp. has bonds with 14.5 years to maturity that

practice questions - please type in the answers - do not post pictures

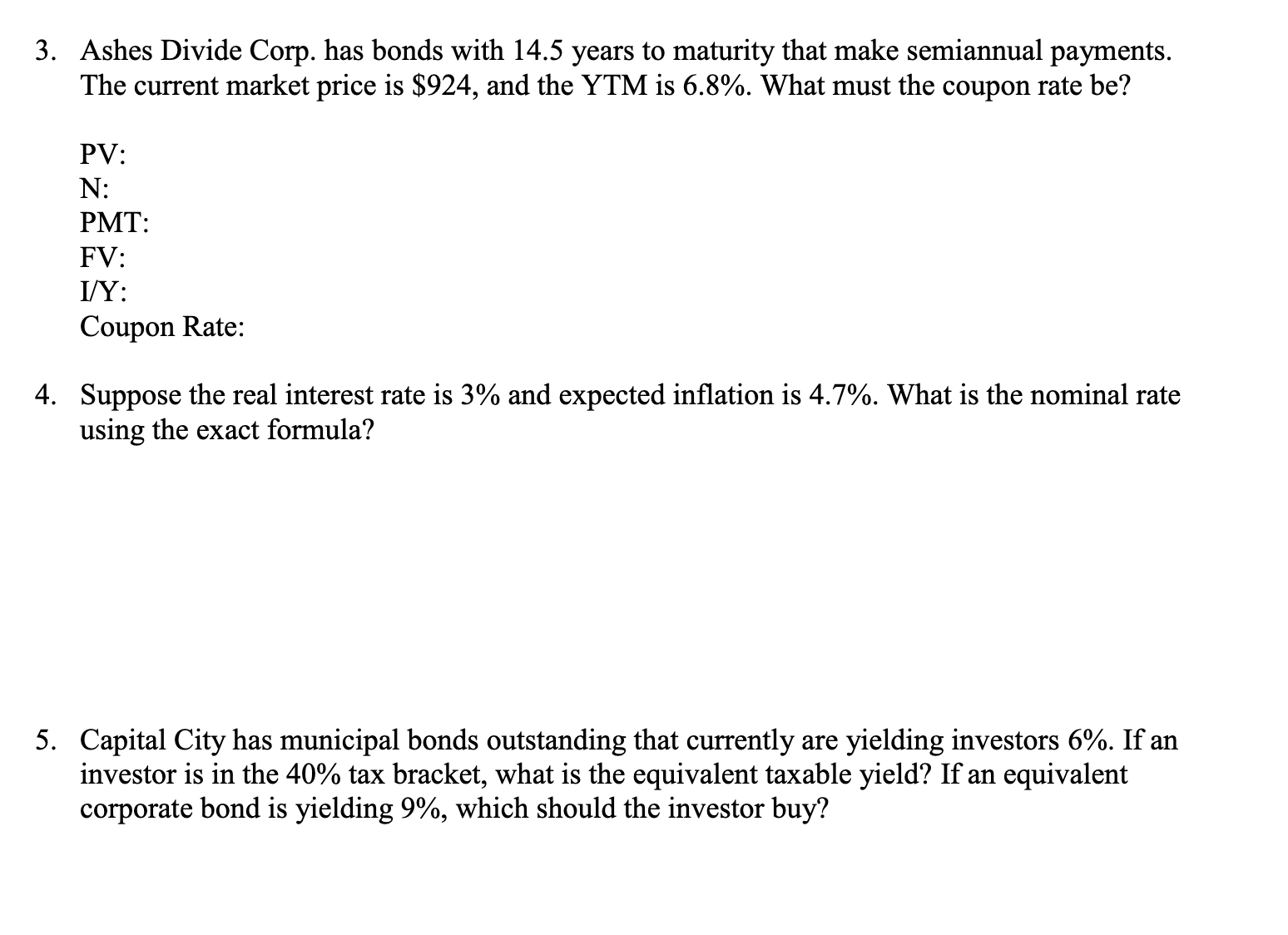

3. Ashes Divide Corp. has bonds with 14.5 years to maturity that make semiannual payments. The current market price is $924, and the YTM is 6.8%. What must the coupon rate be? PV: N: PMT: FV: I/Y: Coupon Rate: 4. Suppose the real interest rate is 3% and expected ination is 4.7%. What is the nominal rate using the exact formula? 5. Capital City has municipal bonds outstanding that currently are yielding investors 6%. If an investor is in the 40% tax bracket, what is the equivalent taxable yield? If an equivalent corporate bond is yielding 9%, which should the investor buy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts