Question: PRACTICE QUESTIONS. PLEASE SHOW ALL WORK. USE DATA BELOW FOR 22-23 22. Which one is the midpoint of the range of the marginal cost of

PRACTICE QUESTIONS. PLEASE SHOW ALL WORK.

USE DATA BELOW FOR 22-23

22. Which one is the midpoint of the range of the marginal cost of common equity, calculated from the above data?

a. 11.10% b. 10% c. 14.2% d. 14.0% e. 9%

CAPM=7%+(6%) x 1.2 rd +RP=5%x2+4%=14.0%, DCF= (4.3995/50)X100+5%=13.8%

Mid point is 14% among 14.2%, 14%, and 13.8%

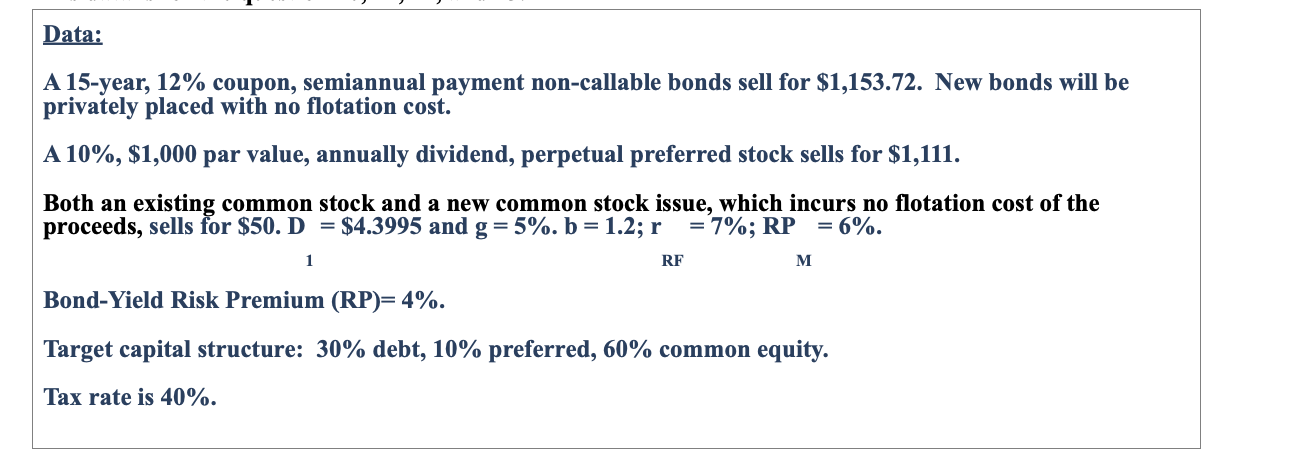

Data: A 15-year, 12% coupon, semiannual payment non-callable bonds sell for $1,153.72. New bonds will be privately placed with no flotation cost. A 10%, $1,000 par value, annually dividend, perpetual preferred stock sells for $1,111. Both an existing common stock and a new common stock issue, which incurs no flotation cost of the proceeds, sells for $50. D = $4.3995 and g = 5%. b = 1.2; r = 7%; RP = 6%. 1 RF M Bond-Yield Risk Premium (RP)= 4%. Target capital structure: 30% debt, 10% preferred, 60% common equity. Tax rate is 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts