Question: QUESTION 1 According to the Efficient Markets Hypothesis (EMH): A. You can buy the stock in anticipation of good news and expect to make a

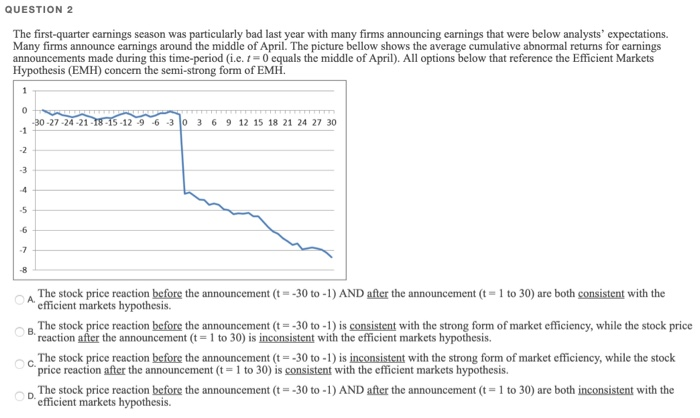

QUESTION 1 According to the Efficient Markets Hypothesis (EMH): A. You can buy the stock in anticipation of good news and expect to make a return on your investment without taking systematic risk B. You can short-sell the stock in anticipation of negative news and expect to make a return on your investment without taking systematic risk C. Changes in stock prices should not be predictable Stock prices do not fully account for news as it is released. Instead the news is gradually reflected in the stock price over a period lasting at least several weeks. QUESTION 2 The first-quarter earnings season was particularly bad last year with many firms announcing earnings that were below analysts' expectations. Many firms announce earnings around the middle of April. The picture bellow shows the average cumulative abnormal returns for earnings announcements made during this time period i.e. t=0 equals the middle of April). All options below that reference the Efficient Markets Hypothesis (EMH) concern the semi-strong form of EMH. -30-27-24-21 -18-15 -12 -9 -6 -3 0 3 6 9 12 15 18 21 24 27 30 The stock price reaction before the announcement (t=-30 to -1) AND after the announcement (t = 1 to 30) are both consistent with the efficient markets hypothesis. The stock price reaction before the announcement (t=-30 to -1) is consistent with the strong form of market efficiency, while the stock price B. "reaction after the announcement (t = 1 to 30) is inconsistent with the efficient markets hypothesis. The stock price reaction before the announcement (t=-30 to -1) is inconsistent with the strong form of market efficiency, while the stock price reaction after the announcement (t = 1 to 30) is consistent with the efficient markets hypothesis. The stock price reaction before the announcement (t = -30 to -1) AND after the announcement (t = 1 to 30) are both inconsistent with the efficient markets hypothesis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts