Question: Practice Set #3-S Corporation Tax Return Preparation Assignment John Jones (123-45-6781) and George Ryan (123-45-6782) are 50% and 50% owners, respectively of Krupp, Inc. (11-1111120),

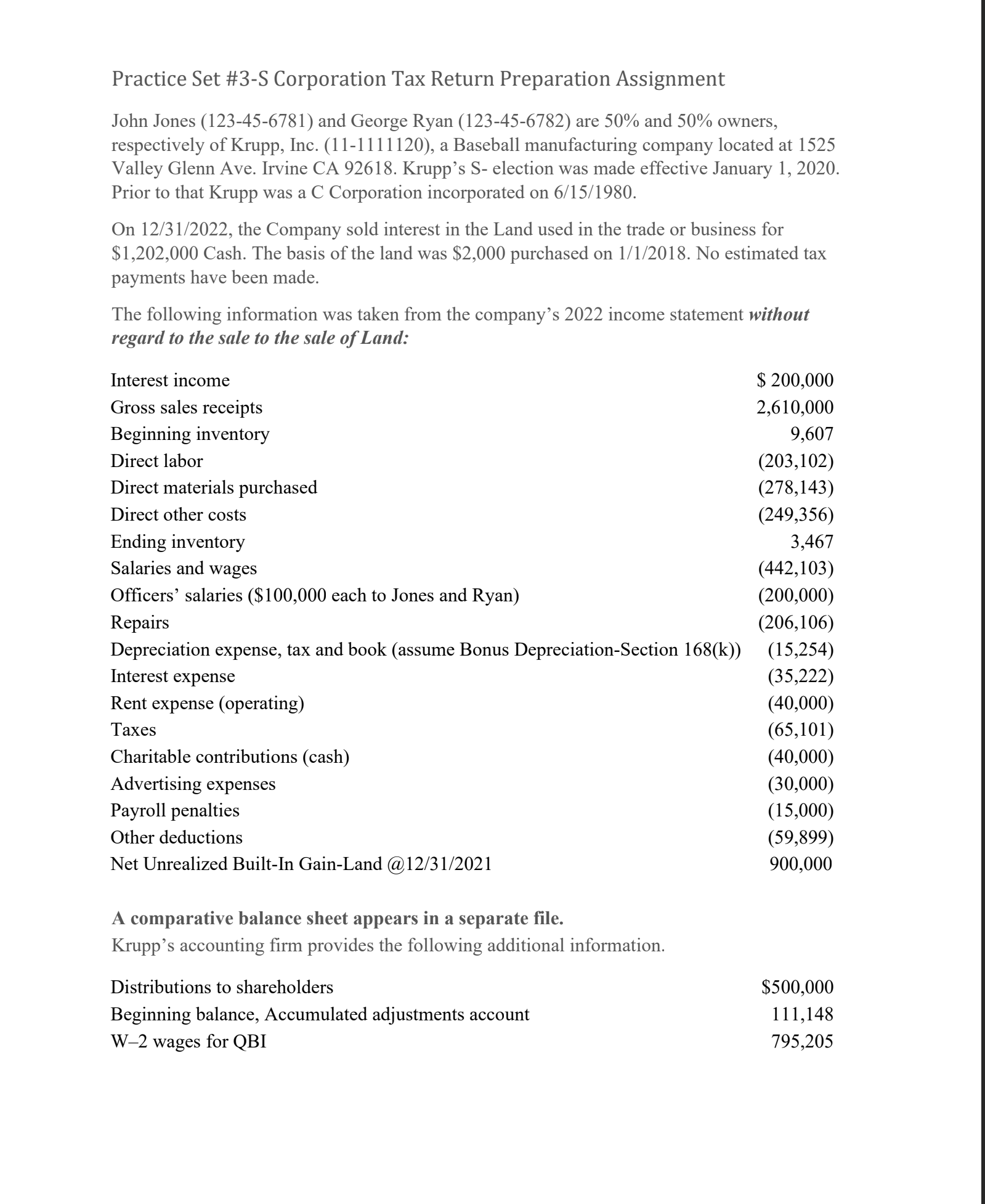

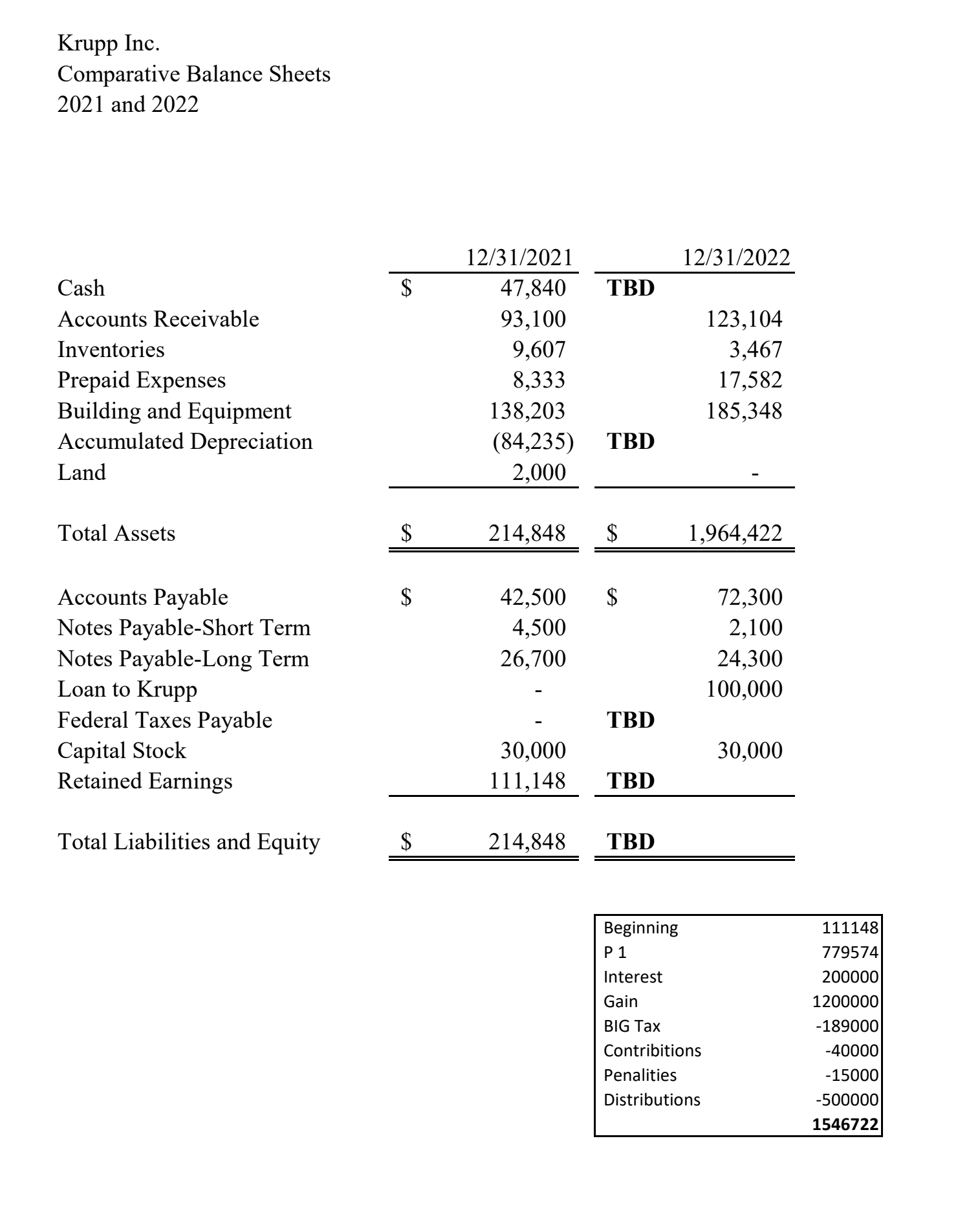

Practice Set #3-S Corporation Tax Return Preparation Assignment John Jones (123-45-6781) and George Ryan (123-45-6782) are 50% and 50% owners, respectively of Krupp, Inc. (11-1111120), a Baseball manufacturing company located at 1525 Valley Glenn Ave. Irvine CA 92618. Krupp's S- election was made effective January 1, 2020. Prior to that Krupp was a C Corporation incorporated on 6/15/1980. On 12/31/2022, the Company sold interest in the Land used in the trade or business for $1,202,000 Cash. The basis of the land was $2,000 purchased on 1/1/2018. No estimated tax payments have been made. The following information was taken from the company's 2022 income statement without regard to the sale to the sale of Land: Interest income $ 200,000 Gross sales receipts 2,610,000 Beginning inventory 9,607 Direct labor (203,102) Direct materials purchased (278,143) Direct other costs (249,356) Ending inventory 3,467 Salaries and wages (442, 103) Officers' salaries ($100,000 each to Jones and Ryan) (200,000) Repairs (206,106) Depreciation expense, tax and book (assume Bonus Depreciation-Section 168(k)) (15,254) Interest expense (35,222) Rent expense (operating) (40,000) Taxes (65,101) Charitable contributions (cash) (40,000) Advertising expenses (30,000) Payroll penalties (15,000) Other deductions (59,899) Net Unrealized Built-In Gain-Land @12/31/2021 900,000 A comparative balance sheet appears in a separate file. Krupp's accounting firm provides the following additional information. Distributions to shareholders $500,000 Beginning balance, Accumulated adjustments account 111,148 W-2 wages for QBI 795,205Practice Set #3-S Corporation Tax Return Preparation Assignment John Jones (123-45-6781) and George Ryan (123-45-6782) are 50% and 50% owners, respectively of Krupp, Inc. (11-1111120), a Baseball manufacturing company located at 1525 Valley Glenn Ave. Irvine CA 92618. Krupp's S- election was made effective January 1, 2020. Prior to that Krupp was a C Corporation incorporated on 6/15/1980. On 12/31/2022, the Company sold interest in the Land used in the trade or business for $1,202,000 Cash. The basis of the land was $2,000 purchased on 1/1/2018. No estimated tax payments have been made. The following information was taken from the company's 2022 income statement without regard to the sale to the sale of Land: Interest income $ 200,000 Gross sales receipts 2,610,000 Beginning inventory 9,607 Direct labor (203,102) Direct materials purchased (278,143) Direct other costs (249,356) Ending inventory 3,467 Salaries and wages (442, 103) Officers' salaries ($100,000 each to Jones and Ryan) (200,000) Repairs (206,106) Depreciation expense, tax and book (assume Bonus Depreciation-Section 168(k)) (15,254) Interest expense (35,222) Rent expense (operating) (40,000) Taxes (65,101) Charitable contributions (cash) (40,000) Advertising expenses (30,000) Payroll penalties (15,000) Other deductions (59,899) Net Unrealized Built-In Gain-Land @12/31/2021 900,000 A comparative balance sheet appears in a separate file. Krupp's accounting firm provides the following additional information. Distributions to shareholders $500,000 Beginning balance, Accumulated adjustments account 111,148 W-2 wages for QBI 795,205Krupp Inc. Comparative Balance Sheets 2021 and 2022 12/31/2021 12/31/2022 Cash $ 47,840 TBD Accounts Receivable 93,100 123,104 Inventories 9,607 3,467 Prepaid Expenses 8,333 17,582 Building and Equipment 138,203 185,348 Accumulated Depreciation (84,235) TBD Land 2,000 Total Assets $ 214,848 $ 1,964,422 Accounts Payable $ 42,500 $ 72,300 Notes Payable-Short Term 4,500 2,100 Notes Payable-Long Term 26,700 24,300 Loan to Krupp 100,000 Federal Taxes Payable TBD Capital Stock 30,000 30,000 Retained Earnings 111,148 TBD Total Liabilities and Equity $ 214,848 TBD Beginning 111148 P 1 779574 Interest 200000 Gain 1200000 BIG Tax 189000 Contribitions -40000 Penalities -15000 Distributions -500000 1546722Krupp Inc. Comparative Balance Sheets 2021 and 2022 12/31/2021 12/31/2022 Cash $ 47,840 TBD Accounts Receivable 93,100 123,104 Inventories 9,607 3,467 Prepaid Expenses 8,333 17,582 Building and Equipment 138,203 185,348 Accumulated Depreciation (84,235) TBD Land 2,000 Total Assets $ 214,848 $ 1,964,422 Accounts Payable $ 42,500 $ 72,300 Notes Payable-Short Term 4,500 2,100 Notes Payable-Long Term 26,700 24,300 Loan to Krupp 100,000 Federal Taxes Payable TBD Capital Stock 30,000 30,000 Retained Earnings 111,148 TBD Total Liabilities and Equity $ 214,848 TBD Beginning 111148 P 1 779574 Interest 200000 Gain 1200000 BIG Tax 189000 Contribitions -40000 Penalities -15000 Distributions -500000 1546722

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts