Question: > Practice Set P3-47 Preparing adjusting entries and preparing an adjusted trial balance This problem continues the Crystal Clear Cleaning situation from Chapter 2. Start

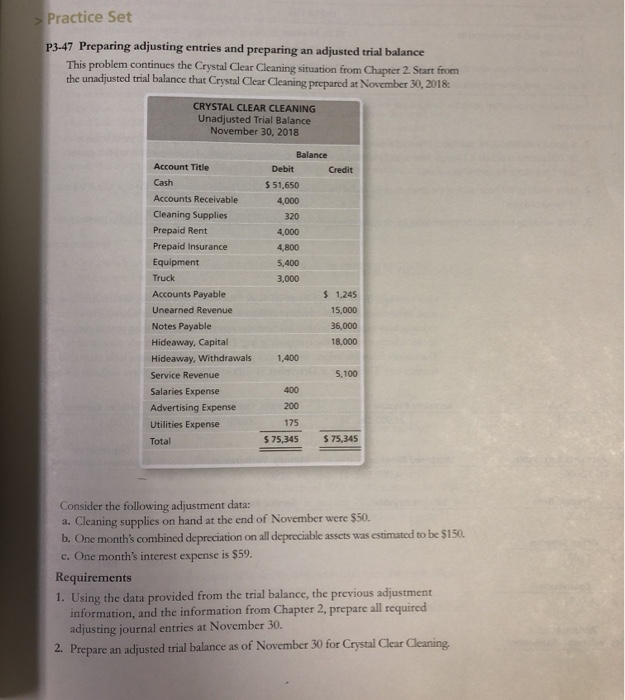

> Practice Set P3-47 Preparing adjusting entries and preparing an adjusted trial balance This problem continues the Crystal Clear Cleaning situation from Chapter 2. Start from the unadjusted trial balance that Crystal Clear Cleaning prepared at November 30, 2018 CRYSTAL CLEAR CLEANING Unadjusted Trial Balance November 30, 2018 Account Title Cash Accounts Receivable Cleaning Supplies Prepaid Rent Prepaid Insurance Equipment Truck Accounts Payable Unearned Revenue Notes Payable Hideaway, Capital Hideaway, Withdrawals Service Revenue Salaries Expense Advertising Expense Utilities Expense Total Balance Debit Credit $ 51,650 4,000 320 4.000 4,800 5,400 3,000 $ 1.245 15,000 36,000 18,000 1,400 5,100 400 200 175 $75.345 $ 75,345 Consider the following adjustment data: a. Cleaning supplies on hand at the end of November were $50. b. One month's combined depreciation on all depreciable assets was estimated to be $150. c. One month's interest expense is $59. Requirements 1. Using the data provided from the trial balance, the previous adjustment information, and the information from Chapter 2, prepare all required adjusting journal entries at November 30. 2. Prepare an adjusted trial balance as of November 30 for Crystal Clear Cleaning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts