Question: Practise Q 1 QUESTION 1 (6 + 1 = 7 marks) Crunch Craft, a catering company, provides catering services to its customers. Customers normally pay

Practise Q 1

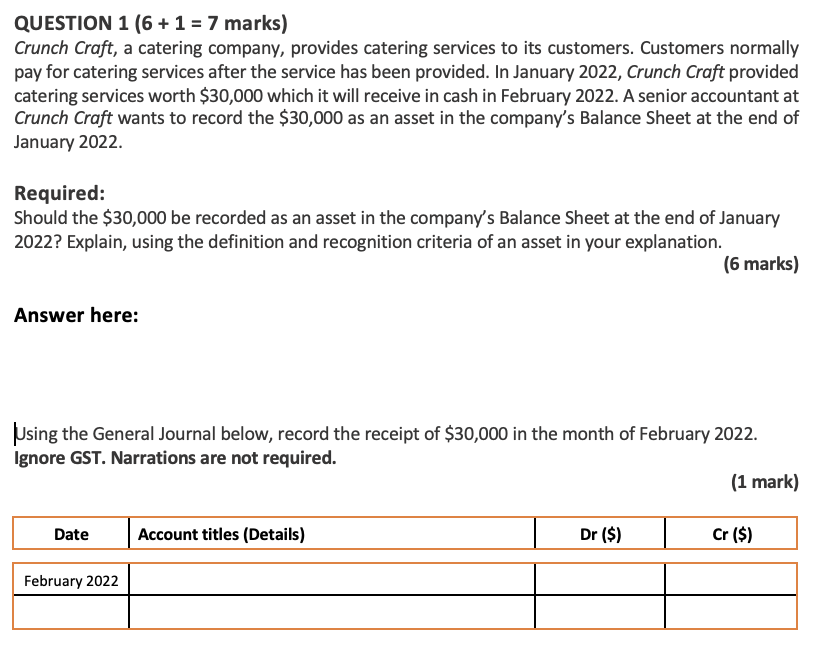

QUESTION 1 (6 + 1 = 7 marks) Crunch Craft, a catering company, provides catering services to its customers. Customers normally pay for catering services after the service has been provided. In January 2022, Crunch Craft provided catering services worth $30,000 which it will receive in cash in February 2022. A senior accountant at Crunch Craft wants to record the $30,000 as an asset in the company's Balance Sheet at the end of January 2022. Required: Should the $30,000 be recorded as an asset in the company's Balance Sheet at the end of January 2022? Explain, using the definition and recognition criteria of an asset in your explanation. (6 marks) Answer here: using the General Journal below, record the receipt of $30,000 in the month of February 2022. Ignore GST. Narrations are not required. (1 mark) Date Account titles (Details) Dr ($) Cr ($) February 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts