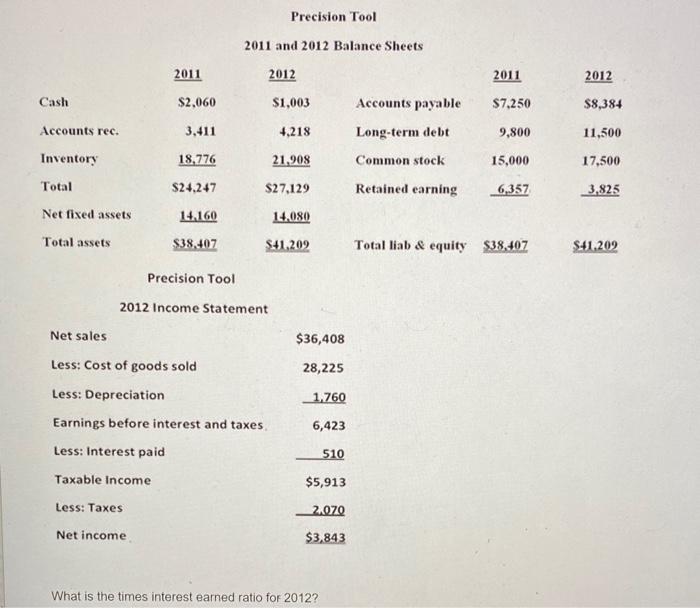

Question: Precision Tool 2011 and 2012 Balance Sheets 2011 2012 2011 2012 Cash $2,060 $1,003 $7.250 $8,384 Accounts rec. 3,411 4,218 Accounts payable Long-term debt Common

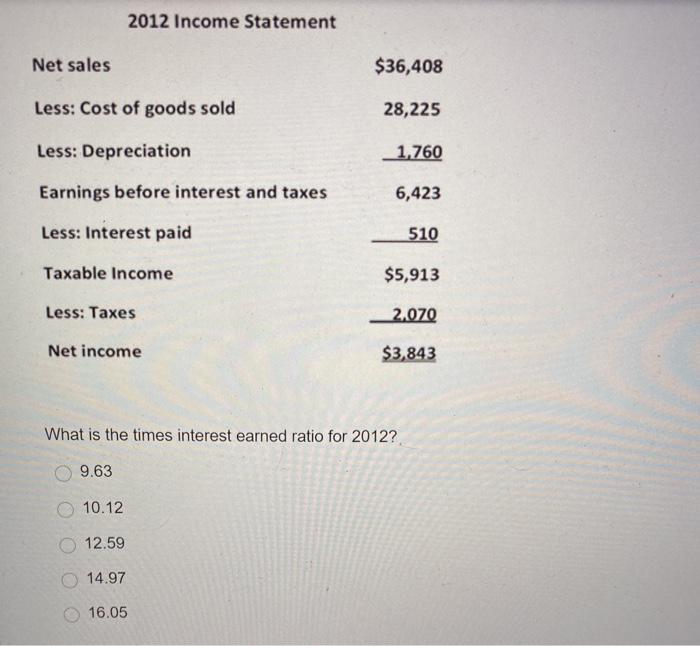

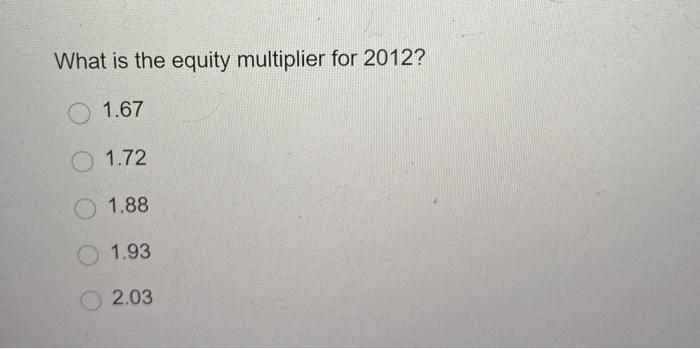

Precision Tool 2011 and 2012 Balance Sheets 2011 2012 2011 2012 Cash $2,060 $1,003 $7.250 $8,384 Accounts rec. 3,411 4,218 Accounts payable Long-term debt Common stock 9,800 11,500 Inventory 18.776 21,908 15,000 17,500 Total $24.247 $27.129 Retained earning 6,357 3.825 Net fixed assets 14.160 14.080 Total assets $38,407 $41,209 Total liab & equity $38,407 $41.202 Precision Tool 2012 Income Statement Net sales $36,408 Less: Cost of goods sold 28,225 Less: Depreciation 1.760 6,423 Earnings before interest and taxes Less: Interest paid 510 Taxable income $5,913 Less: Taxes 2.070 Net income $3,843 What is the times interest earned ratio for 2012? 2012 Income Statement Net sales $36,408 Less: Cost of goods sold 28,225 Less: Depreciation 1,760 Earnings before interest and taxes 6,423 Less: Interest paid 510 Taxable income $5,913 Less: Taxes 2.070 Net income $3,843 What is the times interest earned ratio for 2012? 9.63 10.12 O 12.59 14.97 16.05 What is the equity multiplier for 2012? 1.67 1.72 1.88 1.93 2.03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts