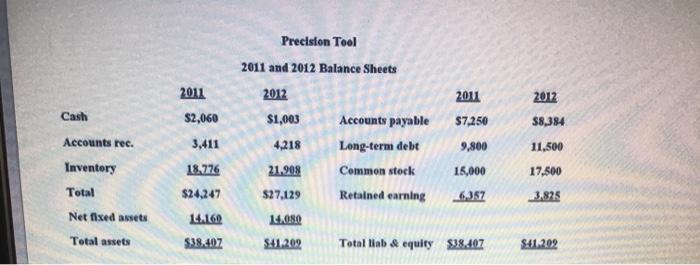

Question: 2011 2011 2012 Cash $2,060 $7.250 Precision Tool 2011 and 2012 Balance Sheets 2012 $1,003 Accounts payable 4,218 Long-term debt 21.908 Common stock $27.129 Retained

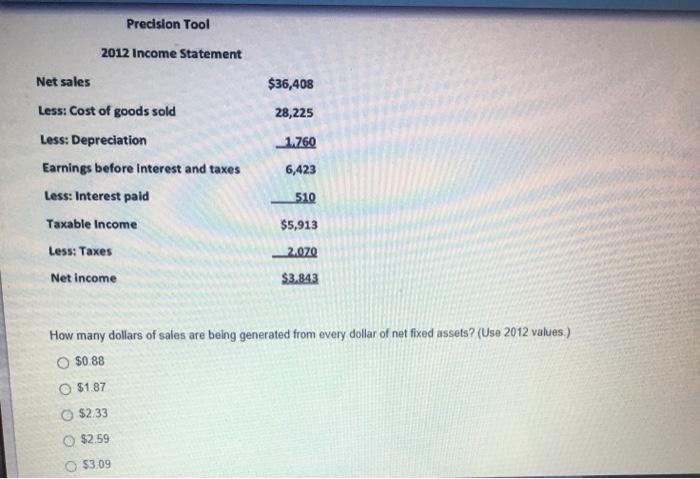

2011 2011 2012 Cash $2,060 $7.250 Precision Tool 2011 and 2012 Balance Sheets 2012 $1,003 Accounts payable 4,218 Long-term debt 21.908 Common stock $27.129 Retained earning 14.080 $8,384 Accounts rec. 3,411 9,800 11,500 15,000 17.500 Inventory Total 6,357 3.825 18,776 $24,247 14.160 $18.402 Net fixed assets Total assets $41.202 Total liab & equity $18.407 S41202 Precision Tool 2012 Income Statement Net sales $36,408 Less: Cost of goods sold 28,225 1.760 Less: Depreciation Earnings before interest and taxes Less: Interest paid 6,423 510 Taxable income $5,913 Less: Taxes 2.070 Net income $3.843 How many dollars of sales are being generated from every dollar of net fixed assets? (Use 2012 values.) O $0.88 O $1.87 $2.33 $2.59 O $3.09

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts