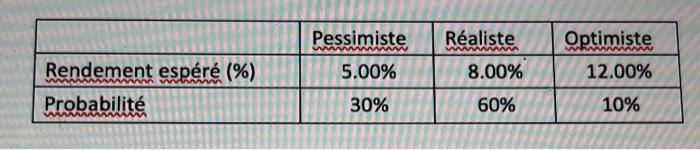

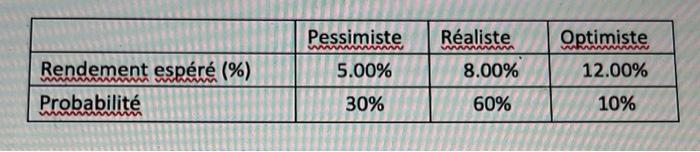

Question: #Precisy the formulas you will use (DO NOT USE EXCEL) Problem 3 (10 points) Looking ahead to next year, the expected returns for ABC Company

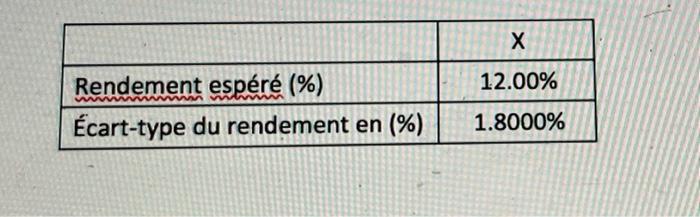

Raliste WAWA w Pessimiste 5.00% Optimiste 12.00% 8.00% mwWw Rendement espr (%) Probabilit 30% 60% 10% Pessimiste Raliste Optimiste WWWWWWWWW WAVAANANA www 5.00% 8.00% 12.00% Rendement espr (%) Probabilit 30% 60% 10% 12.00% Rendement espr (%) cart-type du rendement en (%) 1.8000% Raliste WAWA w Pessimiste 5.00% Optimiste 12.00% 8.00% mwWw Rendement espr (%) Probabilit 30% 60% 10% Pessimiste Raliste Optimiste WWWWWWWWW WAVAANANA www 5.00% 8.00% 12.00% Rendement espr (%) Probabilit 30% 60% 10% 12.00% Rendement espr (%) cart-type du rendement en (%) 1.8000%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts